The most popular dog in the country for the past two years has been the French bulldog, popular for its bat-like ears and deep wrinkles. However, their flat faces make them prone to respiratory and eye problems.

That may be why Frenchies are the second most expensive dog breed to insure after the Cane Corso, a mastiff, according to Spot Pet Insurance, one of dozens of companies that offer health insurance for pets. The company recently ranked the most expensive dog and cat breeds, noting that some purebred dogs may be more expensive because their genetic makeup makes them susceptible to certain health conditions.

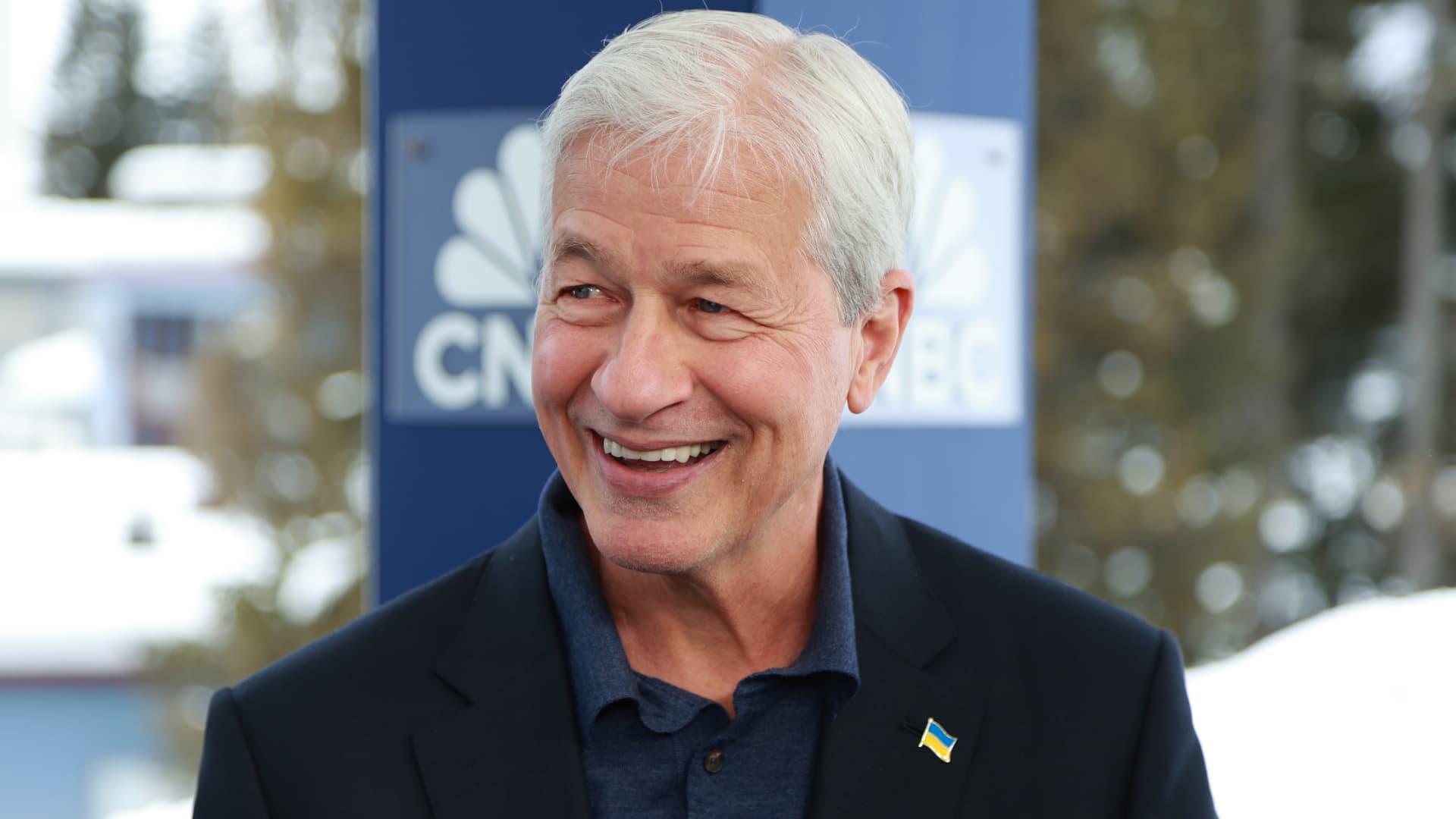

The rankings were based on average insurance premiums as well as the most expensive claim for the breed, said Trey Ferro, chief executive of Spot Pet Insurance, which has 330,000 active policies. (The age of the dog and the type of policy chosen may also affect costs, the company says.)

The cheapest breeds to insure, however, were the Chihuahua and the Maltipoo, a Maltese-Poodle mix.

Dr. Jerry Klein, chief veterinary officer for the American Kennel Club, noted that most of the dog breeds on the list of most expensive dog breeds to insure — aside from the compact Frenchie — were larger animals, while small breeds dominated the least expensive dog breeds list.

“Big dogs cost more, period,” said Dr. Small. They eat more, they need larger boxes and other equipment, and when they need medical care, they need larger doses of drugs and anesthetics, he said.

Regardless of race, Dr. Small, “any dog can get sick.” Mixed-breed dogs are less susceptible to genetic diseases, according to the North American Pet Health Insurance Association, a trade group whose three dozen members insure most insured pets. However, they can be injured or develop illnesses in accidents or dogfights.

The most common dog ailments that lead to claims include gastrointestinal problems such as diarrhea and vomiting, skin conditions, urinary tract infections, ear infections and allergies, according to the insurance association.

And treatment costs are rising. According to the Bureau of Labor Statistics, the overall consumer price index rose 3.4 percent in April from a year earlier, while the veterinary services category rose 7.1 percent. Contributing to the rise in veterinary costs are a shortage of veterinarians and technicians, more sophisticated medications and treatments, and increasing investor involvement in veterinary practices.

The most expensive pet claim in 2023 was $51,133 for a golden retriever with lymphoma, according to the Pet Health Insurance Association. Other top claims included $46,900 for a vomiting black and tan coonhound and $43,389 for treatment of a French bulldog with a corneal ulcer.

Mr. Ferro said his own German Shepherd died of liver cancer about six months ago, resulting in a $12,000 bill for three months of chemotherapy. (His insurance policy covered all but $2,000.) And when a Labrador retriever belonging to another company employee swallowed a bagel speared with a toothpick, he said, so did the bulk of the resulting $10,500 surgical bill -dollars covered.

Bills like these make it clear why more and more pet owners are interested in insurance. According to the Pet Health Insurance Association, about 5.7 million pets were insured in the United States in 2023, up from 4.8 million in 2022.

While people have always had a strong bond with their pets, it became even stronger during the pandemic as people stayed home all day, said Kristen Lynch, the association’s executive director. Many pet owners let their dogs sleep in their beds, and half of American owners consider their pets — especially dogs — to be as much a part of their family as human relatives, a Pew Research Center survey found.

“Over the course of our lives, we have gone from the barnyard to the backyard to the bedroom,” Ms. Lynch said, which is why people are reluctant to be faced with a situation where they cannot pay for a pet’s life-saving treatment.

But choosing pet insurance can be challenging because rates vary not only by breed, but also by the pet’s age and location, as well as the type of policy, said Brian Vines, deputy special projects editor at Consumer Reports, who recently analyzes pet insurance has. Pet insurance offers many options and can be customized, he said, but that makes it difficult to compare because “there are so many differences.” Deductibles and co-pays can add up to significant bills even with insurance, Mr. Vines said.

His advice is to call multiple insurers and get quotes for your specific needs. “You really have to do the legwork,” he said.

Despite incidents of covering large bills, a survey of about 2,000 Consumer Reports readers with pet insurance found that “most people are breaking even at best.”

The average monthly health insurance premium in 2023 was about $56 for accident and illness coverage for a dog and about $32 for a cat, according to the insurance association. Such policies cover injuries caused by eating unauthorized amounts, cuts, car accidents, ruptured ligaments and poisoning, as well as treatment for cancer, infections and digestive problems. Some offer wellness coverage such as routine vaccinations and dental care at an additional cost.

And what about cats?

The most expensive cats to insure were the Maine Coon, one of the largest domestic cats that can be prone to a type of muscle wasting, and the chinchilla, a popular long-haired cat, according to Spot Pet Insurance. The cheapest were Russian Blue and Siamese.

Here are some questions and answers about pet healthcare costs:

How does pet health insurance work?

Generally, you select the vet you want, pay the bill upfront, and then request reimbursement from the insurance company. (Most companies process claims within a day or two, although complex claims can take up to two weeks, says the Pet Health Insurance Association.) Policies typically have a waiting period of one or two to 30 days for coverage to begin. The policies generally do not cover pre-existing conditions. As pets age, they generally require more care, so your premium and deductible will typically increase over time. Some insurers no longer offer new insurance coverage for pets past a certain age. Some policies may offer discounts for multiple pet coverage.

How can I reduce the risk of getting a dog with serious health conditions?

Dr. Klein, of the American Kennel Club, recommended researching the breed’s characteristics and finding a reputable breeder, such as one recognized by the club as a “Breeder of Merit,” meaning the breeder meets criteria such as carrying out tests recommended for the breed Health examinations fulfilled. On the kennel club website you will find a directory of individual breeding clubs that can provide recommendations. Another resource he suggested is the Orthopedic Foundation for Animals, a nonprofit organization in Columbia, Missouri, that works with breeders to promote screening for genetic diseases such as hip dysplasia in dogs, a degenerative disease that causes loose joints and causes arthritis.

What if I can’t afford vet bills or pet health insurance?

Mr. Vines suggests calling local veterinarians to find out prices for services, as they can vary widely. Some practices may allow you to pay over time or set aside funds to cover the cost of care if the owners cannot afford it. So ask your vet. Additionally, telemedicine services for pets can be less expensive than in-person visits. Try putting money aside in a savings account to cover needed care. The Humane Society offers a Pet Help Finder tool on its website to help you find “financially friendly” veterinarians in your area. Local animal shelters and animal rescue organizations can also offer help or recommendations.

Source link

2024-06-07 13:00:08

www.nytimes.com