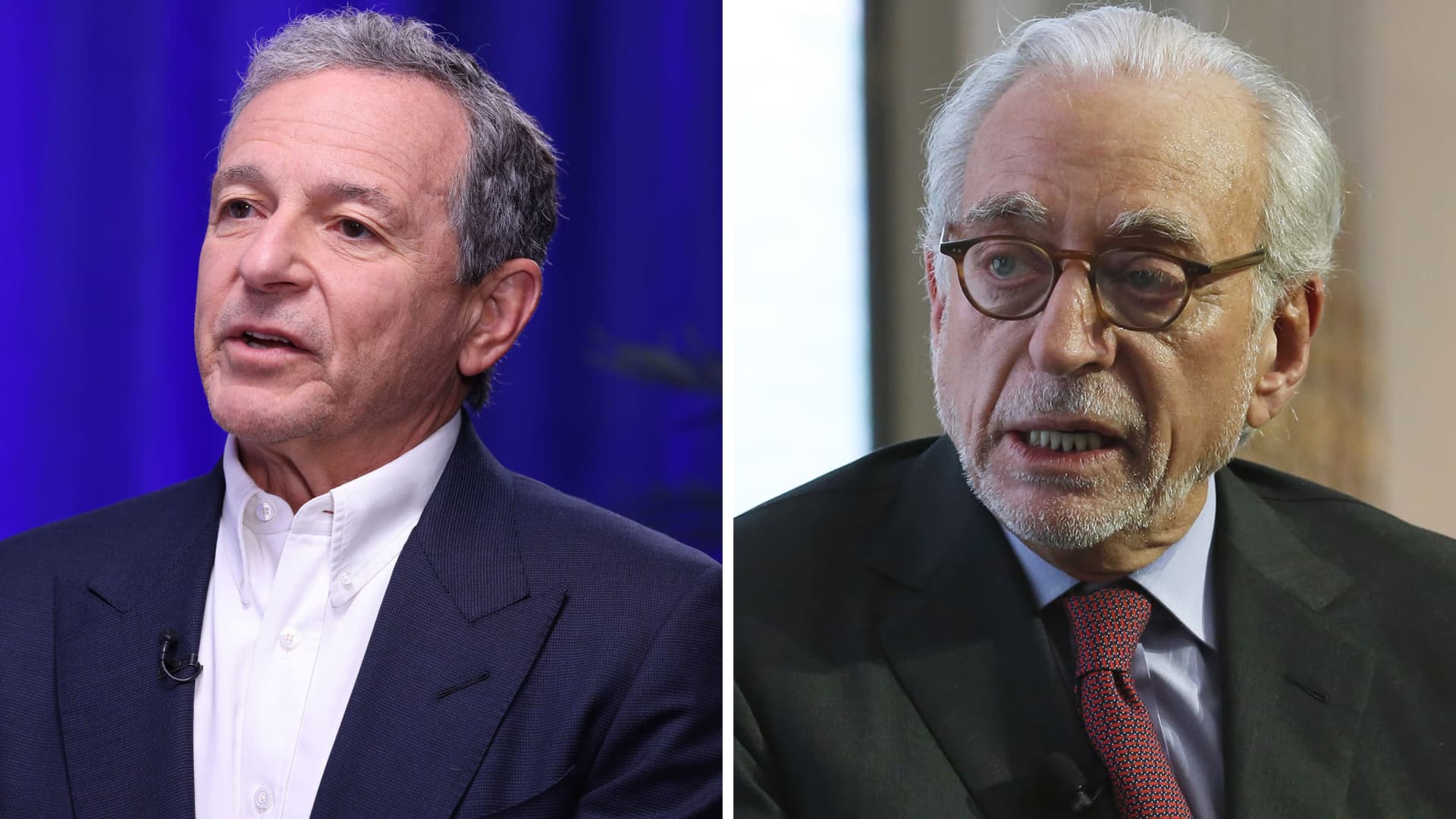

Nikolay Storonsky, founder and CEO of Revolut.

Harry Murphy | Sports file for Web Summit via Getty Images

LONDON – The boss of British financial technology giant Revolut told CNBC he is optimistic about the company’s chances of getting a British banking license, as the company reported record full-year pre-tax profits due to a surge in user numbers.

In an exclusive interview with CNBC, Revolut CEO and co-founder Nikolay Storonsky said the company is confident of receiving its UK banking license after overcoming several key hurdles on its more than three-year journey to approval from regulators.

“Hopefully we get it sooner rather than later,” Storonsky told CNBC via video call. Regulators are “still working on it,” he added, but have not yet expressed any particular concerns about the fintech.

Storonsky noted that Revolut’s massive size meant it took longer for the company to get its banking license approved than it would have for smaller companies. Several small financial institutions with few customers could have received approval for a banking license, he added.

“Smaller companies will be granted British banking licenses,” Storonsky said. “They typically approve someone twice a year,” and these tend to be smaller institutions. “Of course we are very big, so it takes extra time.”

Revolut is a UK licensed electronic money institution (EMI), but cannot yet offer credit products such as credit cards, personal loans or mortgages. A banking license would allow it to offer loans in the UK. The company faced long delays in its application, which it submitted in 2021.

A key problem with the company was that its share structure did not comply with the rules of the Prudential Regulation Authority, the financial services industry regulator that reports to the Bank of England.

Revolut has multiple share classes and some of these share classes were previously associated with preferential rights. A condition set by the Bank of England for granting Revolut a banking license in the UK was to convert the six share classes into ordinary shares.

Revolut has since solved this problem and the company has entered into a deal with a Japanese technology investor SoftBank to transfer his shares in the company into a unified class, waiving preferential rights, according to a person familiar with the matter. The Financial Times first reported on the solution with SoftBank.

2023 a “breakout year”

The fintech giant released financial results on Tuesday showing full-year pre-tax profit rose to 438 million pounds ($545 million) in 2023, after posting a pre-tax loss of 25.4 million pounds in 2022 had. Group revenue rose 95 percent to 1.8 billion pounds ($2.2 billion), up from 920 million pounds ($1.1 billion) in 2022.

Victor Stinga, Revolut’s chief financial officer, said the company’s growth was driven by a record increase in user numbers – Revolut added 12 million customers in 2023 – as well as strong performance across all key business areas, including card fees, foreign exchange and wealth. and subscriptions.

“We view 2023 as what we would call a breakout year from a growth and profitability perspective,” Stinga said in an interview this week.

Stinga said revenue growth was driven by three main factors, including customer growth, strong performance across all key revenue lines and a significant increase in interest income, which he said now accounts for around 28% of Revolut’s revenue.

He added that Revolut had made maintaining financial discipline a key priority in 2023 by limiting operating expenses and adopting a “zero-based budgeting” philosophy, requiring any new expenditure to be justified and accounted for before it be considered acceptable.

This resulted in administrative costs increasing significantly less than revenue, said Stinga. Administrative costs increased by 49%, while revenues almost doubled compared to the previous year.

Revolut has been investing more aggressively in advertising and marketing, he added, with the company investing $300 million in advertising and marketing last year. The company’s business banking solutions are also a top priority: Revolut employs around 900 people for business-to-business sales.

Source link

2024-07-01 23:01:38

www.cnbc.com