Goal applies Shopify to add new and trendier brands to its website.

Starting Monday, the Minneapolis-based discount retailer said businesses that work with Shopify can apply to join Target Plus, its third-party marketplace. Some of Shopify’s customers are smaller or emerging brands that use the e-commerce platform to build and operate a website.

Target and Shopify did not disclose financial terms or length of the deal.

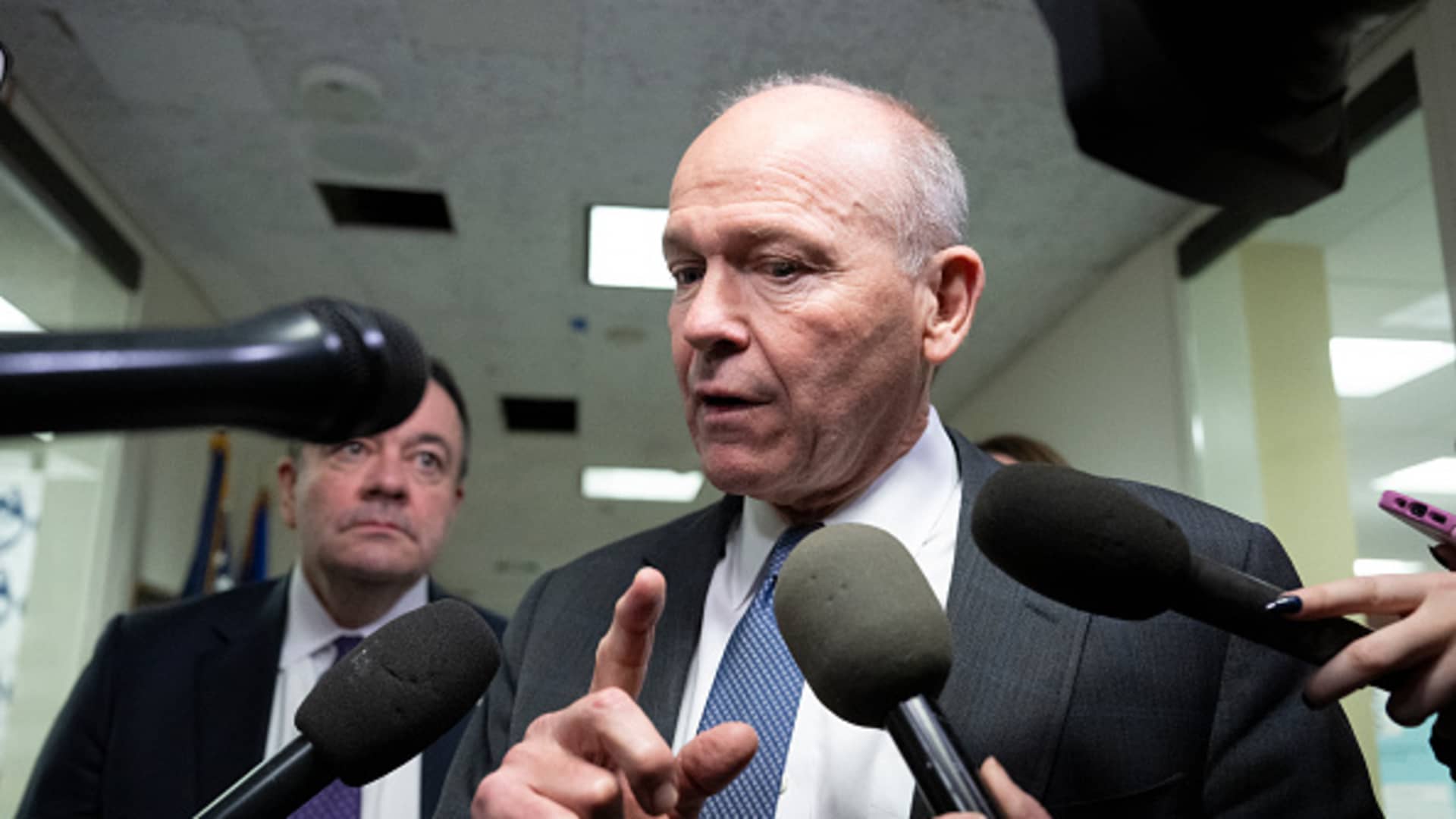

In an interview with CNBC, Cara Sylvester, Target’s chief guest experience officer, said Shopify will help the retailer discover hot items and make them quickly available to Target’s online shoppers. She said Target plans to bring some popular items discovered through the Shopify deal to store shelves.

Target’s marketplace creates a “halo” and is “an accelerator for the entire business,” she said. Sylvester added that as the company expands its online selection and adds eye-catching merchandise, customers are visiting the site more often and purchasing from both marketplace sellers and Target’s own brands.

The major retailer is trying to return to sales growth as consumers buy fewer necessities, while the discounter lags behind grocery competitors Walmart. Target has posted four straight quarters of declining comparable sales, and total sales have fallen in three of the last four quarters.

The company also struggled to grow its e-commerce business. Target’s digital sales rose 1.4% in the first quarter, its first such increase in more than a year.

Company executives said in May that the retailer was on track to return to sales growth in the second quarter, but that was partly due to its weak year-over-year performance. For the full year, Target expects comparable sales to be flat to 2% and adjusted earnings per share to be between $8.60 and $9.60.

Target’s shares have underperformed the broader stock market. As of Friday’s close, the company’s shares were up about 2%, compared with the S&P 500’s rise of nearly 15%. The share price of $146.13 is also well below the highs it reached during the Covid pandemic years, when it topped $260.

Shopify could also use a boost. Shares plunged after the earnings report in May and are down about 17% so far this year.

Target Plus has only a tiny fraction of the revenue and sellers of other third-party marketplaces. Unlike Amazon, Walmart, eBay and others, Target allows brands to join by invitation only. According to Target, there are more than 1,200 sellers. Amazon has about 2 million sellers and Walmart has about 135,000 sellers, according to estimates from Marketplace Pulse, an e-commerce research tracker.

Through the marketplace, Target’s website featured items like the UnBrush, a detangling hairbrush that went viral on TikTok, and premium products like sunglasses from Ray-Ban and Coach. It offers more than 2 million products from brands including Crocs, Ruggable and Timberland. The range extends across many categories including clothing, sporting goods and home decoration.

Target said its marketplace has gained momentum. The number of sellers and products more than doubled in the last calendar year, it said.

The retailer does not share the revenue it generates through its third-party marketplace. Instead, financial filings equate them with “other revenue,” such as revenue from credit card profit-sharing and the Roundel advertising business. This other revenue totaled $388 million, representing less than 2% of the $24.53 billion in revenue the company reported in its most recent quarter ended May 4.

Still, Sylvester said Target Plus is “one of the fastest-growing areas of Target’s business.”

Brands that join Target Plus also become potential Roundel customers. The advertising business grew by more than 20% in the last quarter. Sylvester declined to say how much of that came from ads purchased by Target Plus sellers.

Third-party marketplaces have become a popular area of retail because they tend to generate higher profits. Instead of purchasing goods from suppliers, retailers rely on vendors who typically store and own the inventory. These sellers also assume the financial risk if customers do not want items or the products need to be marked down.

Retailers typically receive a share of sales from sellers. In addition, they may charge fees for services such as processing a brand’s online orders or selling advertising, such as sponsored search results, for sellers’ products.

Target does not offer fulfillment services, instead relying on Target Plus sellers who store, pack and ship their own goods.

Walmart, in particular, has increased its market efforts to close the large gap with Amazon and its dominant e-commerce platform. The company is recruiting sellers and offering new services, such as the ability to ship bulky items like patio furniture or canoes. The number of sellers on Walmart’s U.S. marketplace grew 36% in the first quarter and there are now more than 420 million unique items, CEO Doug McMillon said on the company’s earnings call in mid-May.

Other marketplaces such as TikTok Shop and Temu are also growing rapidly.

Source link

2024-06-24 10:19:26

www.cnbc.com