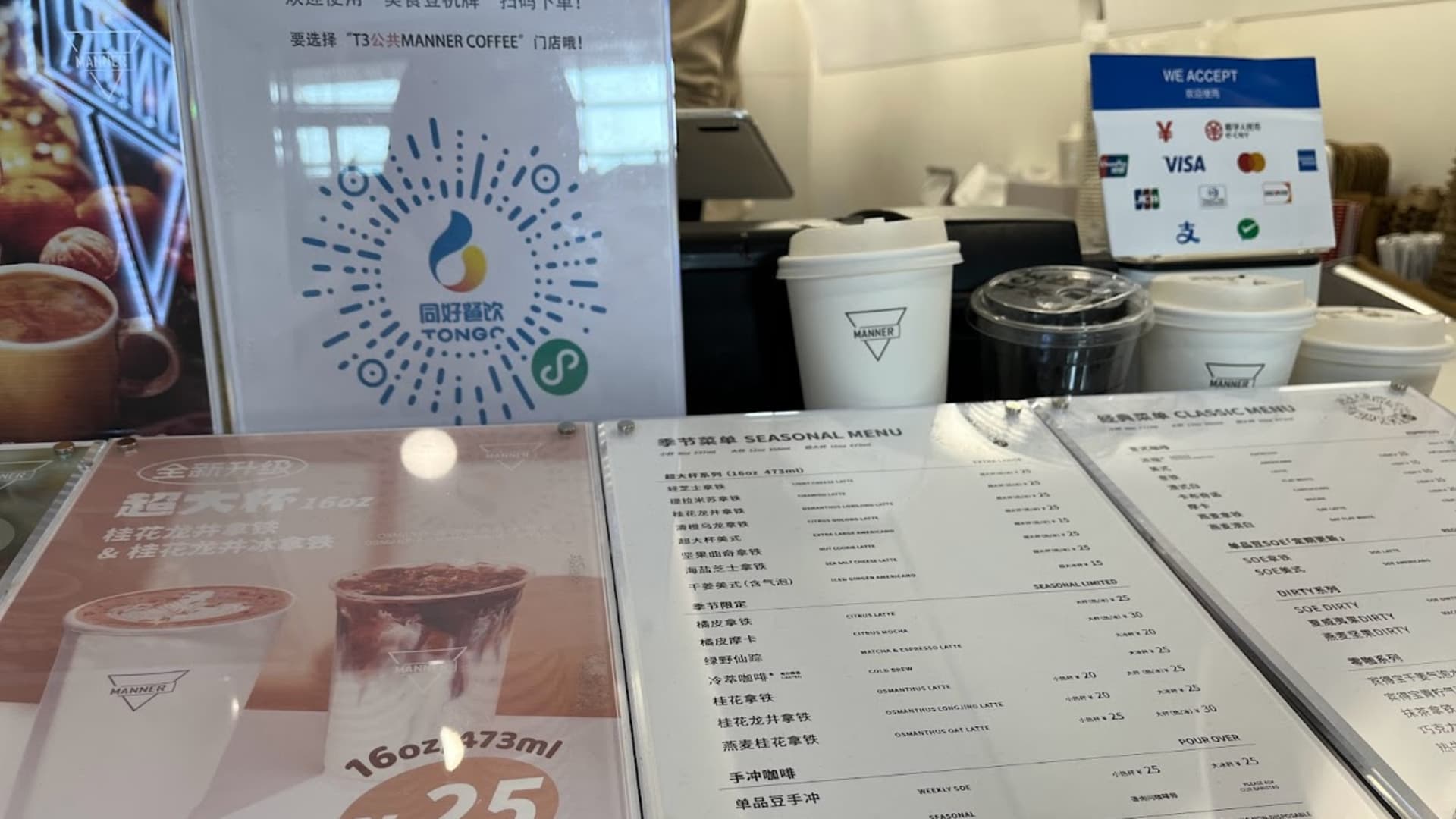

A cafe at Beijing Capital Airport shows that customers can use Visa, Mastercard, the digital Chinese yuan and other payment methods.

CNBC | Evelyn Cheng

BEIJING – China is encouraging banks and local businesses to accept foreign bank cards and is considering further steps to make mobile payments even easier for international visitors, said Zhang Qingsong, deputy governor of the People’s Bank of China.

“Banks and vendors (such as hotels, restaurants, department stores and even cafes) are encouraged to accept foreign bank cards,” Zhang said.

His written comments, exclusive to CNBC, come as Beijing has stepped up efforts to encourage visits by foreign tourists and business people. In recent months, authorities have introduced visa-free travel policies for residents of several European and Southeast Asian countries following strict border controls during the pandemic.

Mobile payments have increased significantly in China in recent years. While it is convenient for locals to scan a QR code with their smartphone to pay, limitations in the financial system have also meant that foreigners often struggle to make payments. Shopping centers are increasingly no longer accepting foreign credit cards.

But that has started to change in recent months.

Last summer, the two dominant mobile payment apps WeChat and AliPay began allowing verified users to link their international credit cards – for example Visas. Tencent owns WeChat, while Alipay is operated by Ali Baba Subsidiary Ant Group.

“We fully understand that foreign visitors care deeply about their privacy,” Zhang said. “We take this issue seriously and have taken steps to protect the information.”

“When using Alipay or WeChat Pay, foreign visitors are now no longer required to provide ID information if their total annual transaction volume is less than $500,” he said. “It is estimated that over 80% of transactions fall below this threshold. We are also exploring the possibility of raising the $500 threshold in the future.”

Zhang and other officials attended an event at Beijing Capital Airport on Monday to officially open a payment services center for foreigners.

While their public statements mentioned the digital yuan, they focused on discussing the availability of cash exchange, greater acceptance of foreign cards and greater support for mobile payments.

The number of travelers to and from mainland China “continued to improve, but both remained below 2019 levels,” Visa executives said on a conference call in late January, according to a FactSet transcript.

Foreign financial services companies are also seeing increased access to China after years of waiting in which international companies criticized Beijing for favoring domestic companies until they were big enough.

Mastercard announced in November that its China joint venture had received approval from the PBOC to begin processing domestic payments. The company waited almost four years before its application to begin preparations was approved in principle.

Read more about China from CNBC Pro

Zhang said China’s plan to support payments for foreigners in the country will focus on enabling card transactions for large payments and mobile payments for smaller amounts.

Users of 13 foreign mobile wallet apps can also use QR payment codes directly in China, Zhang claimed, without naming the apps.

“At the same time, cash is always available and accepted,” he said.

Ant Group said in September that users of 10 major mobile payment apps in countries including Singapore, South Korea and Thailand could use the same apps to scan Alipay QR payment codes in mainland China – a product the company calls Alipay+.

Source link

2024-02-08 00:25:30

www.cnbc.com