An investor observes a stock information board at a brokerage office in Beijing, China.

Jason Lee | AP

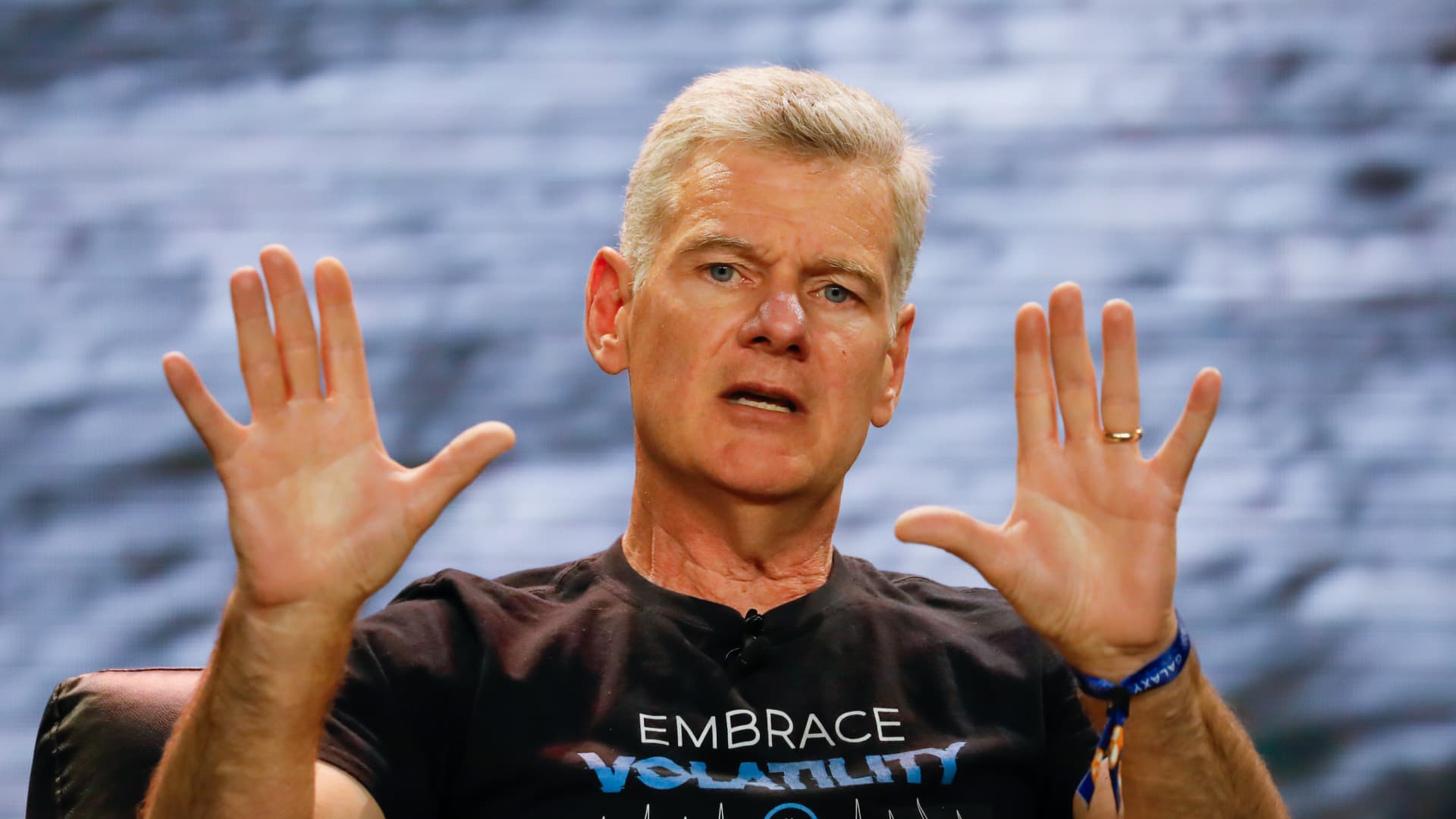

BEIJING – Chinese stocks are likely to rise at least 10% in the coming days as authorities signal concerted support measures, said Marko Papic, partner and chief strategist at Clocktower Group.

Papic specifically pointed to Bloomberg’s report on Tuesday that Chinese President Xi Jinping should be briefed by financial regulators about the recent stock market sell-off. The report, citing sources, said the meeting could have taken place as early as Tuesday.

China’s securities regulator has made several public statements in recent days to boost investor confidence, including announcing government-backed purchases.

“If you’re willing to meet and help with the inventory, why wouldn’t you? [you] “Do something to stabilize growth?” said Papic.

He added that it would be “very strange if the Chinese focused on stabilizing stocks and not on fundamental macroeconomics.”

Beijing has so far refrained from large-scale economic stimulus measures. However, tensions with the US, a weaker-than-expected recovery from the pandemic and a slump in the housing market have sent consumer sentiment down to near record lows.

The National Financial Regulatory Administration and the China Securities Regulatory Commission did not immediately respond to CNBC requests for comment.

Mainland Chinese stocks traded mostly higher on Wednesday after gaining on Tuesday. The Shanghai Composite hit a five-year low on Monday.

“We may have seen a low point in investor sentiment,” Papic said in a telephone interview on Wednesday.

“A 10 to 15 percent rally in Chinese stocks is likely in the coming trading days,” he said. “Tactical bottom fishing moves can be useful.”

That’s a change in Clocktower’s view from last week, when it told investors to “steer clear of bottom fishing.”

Papic said he had been bearish on Chinese stocks over the past 12 months and did not rule out the possibility that the recent rally “could be a dead bounce.” The term refers to a small, short recovery that is followed by the continuation of a downtrend.

Read more about China from CNBC Pro

“But I think the fact that the Chinese government is willing to support stocks and support the economy through fiscal policy is not a huge ideological leap,” he said. “I think they’re moving in the right direction.”

According to Clocktower, it is an alternative asset management platform. It also helps deploy foreign capital in China.

Chinese stocks are still down year to date after a year of losses in 2023.

Papic said one factor in the market selloff this year was that Xi and other senior Chinese officials held a meeting in mid-January that suggested Beijing would focus its anti-corruption efforts on the financial sector.

I’m waiting for more details

Stock markets in mainland China will close on Friday for the week-long Lunar New Year and reopen on Monday, February 18. The Hong Kong Stock Exchange will be closed on February 12th and 13th for the holiday.

It remains unclear to what extent the Chinese authorities are able and willing to act.

Jeremy Stevens, Asia economist at Standard Bank, said in a note on Wednesday that “similar interventions in 2015 failed to achieve their objectives.”

This summer, stocks in mainland China suffered a significant decline from which they have yet to recover.

“It is worth remembering that in August 2015, Chinese stocks suffered their sharpest four-day decline since 1996 amid fears that the government may have to withdraw its market support strategies,” Stevens said.

Looking ahead, he said that “China’s economic growth is expected to decline further without last year’s supportive base effects, and markets will be watching closely as policymakers set a growth target and policy focus at the National People’s Congress in March.”

Source link

2024-02-07 07:30:19

www.cnbc.com