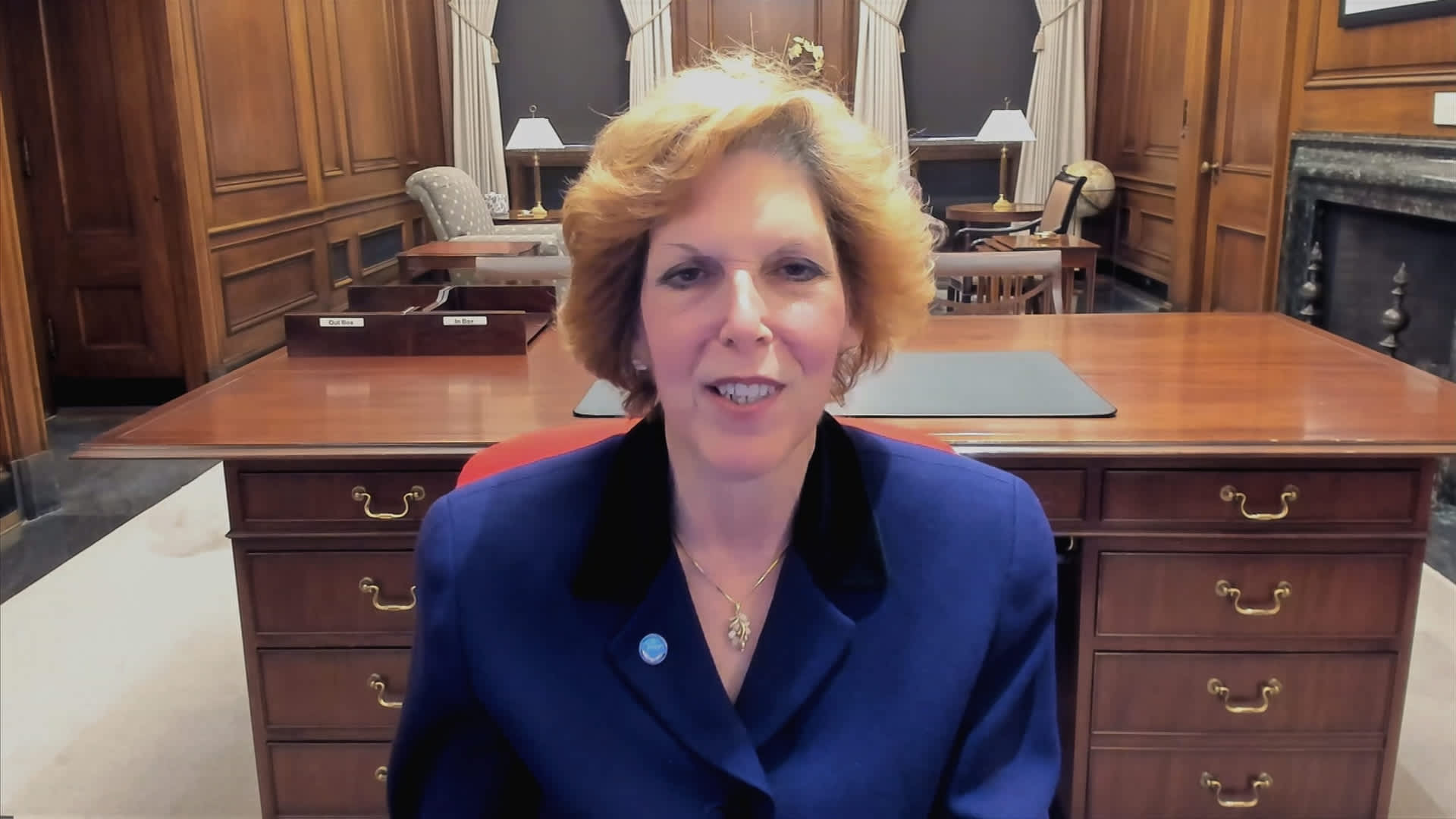

Cleveland Federal Reserve President Loretta Mester said Tuesday she still expects interest rate cuts this year, but ruled out the next policy meeting in May.

Mester also pointed out that the long-term path is higher than policymakers previously thought.

The central bank official pointed to progress on inflation as the economy continued to grow. If this continues, interest rate cuts are likely, although she gave no indication of timing or extent.

“I continue to think the most likely scenario is that inflation continues its downward trend to 2 percent over time. But I need more data to increase my confidence,” Mester said in prepared remarks for a speech in Cleveland.

Additional inflation readings will provide clues as to whether some better-than-expected data points this year were either temporary outliers or a sign that progress on inflation is “stalling,” she added.

“I don’t expect to have enough information to make that decision by the next FOMC meeting,” Mester said.

The comments come nearly two weeks after the Federal Open Market Committee, which sets interest rates, again voted to keep its federal funds rate in a range between 5.25% and 5.5%, where it has been since July 2023 . The statement after the meeting reiterated Mester’s comments that the committee needs to see more evidence that inflation is moving toward the 2 percent target before it begins cutting interest rates.

Mester’s comments appear to rule out a cut at the April 30-May 1 FOMC meeting, a sentiment that is also reflected in market pricing. Mester is a voting member of the FOMC but will leave in June after reaching the 10-year limit.

Futures traders expect the Fed to begin easing interest rates in June and cut them by three-quarters of a percentage point by the end of the year.

San Francisco Fed President Mary Daly said Tuesday that three rate cuts this year was a “very reasonable baseline,” although she said nothing was guaranteed. Daly is a FOMC voter this year.

“Three rate cuts is a forecast, and a forecast is not a promise,” she said, later adding: “We’re getting there, but it won’t be tomorrow, but it won’t be forever.”

While she looks for rate cuts, Mester said she expects the key interest rate to be higher in the long term than the long-standing expectation of 2.5%. Instead, it sees the so-called neutral or “r*” rate at 3%. The rate is considered the level at which the policy is neither restrictive nor stimulative. After the March meeting, the long-term interest rate forecast rose to 2.6%, indicating that there are other members who are also trending higher.

Mester noted that interest rates were very low when the Covid pandemic hit, giving the Fed little room to stimulate the economy.

“At this point, we are trying to align our policies well with economic development so that we don’t have to act aggressively,” she said.

Don’t miss these stories from CNBC PRO:

Source link

2024-04-02 18:02:11

www.cnbc.com