The Federal Trade Commission filed a lawsuit Monday to block Tapestry’s $8.5 billion acquisition of Capri, a blockbuster fashion collaboration that would bring together Coach, Kate Spade, Michael Kors and Versace.

The lawsuit is a rare move by the agency to block a fashion deal, as the industry is not suffering from a lack of competition. In her nearly three years as chair of the FTC, Lina Khan’s priority has been to seize the power of major corporations in cross-industry lawsuits. The agency has tried to block the supermarket merger between Kroger and Albertsons, Meta’s acquisition of virtual reality start-up Within and Microsoft’s acquisition of gaming giant Activision.

The results were mixed: The FTC failed to block the Microsoft deal and the Meta acquisition, both of which closed last year.

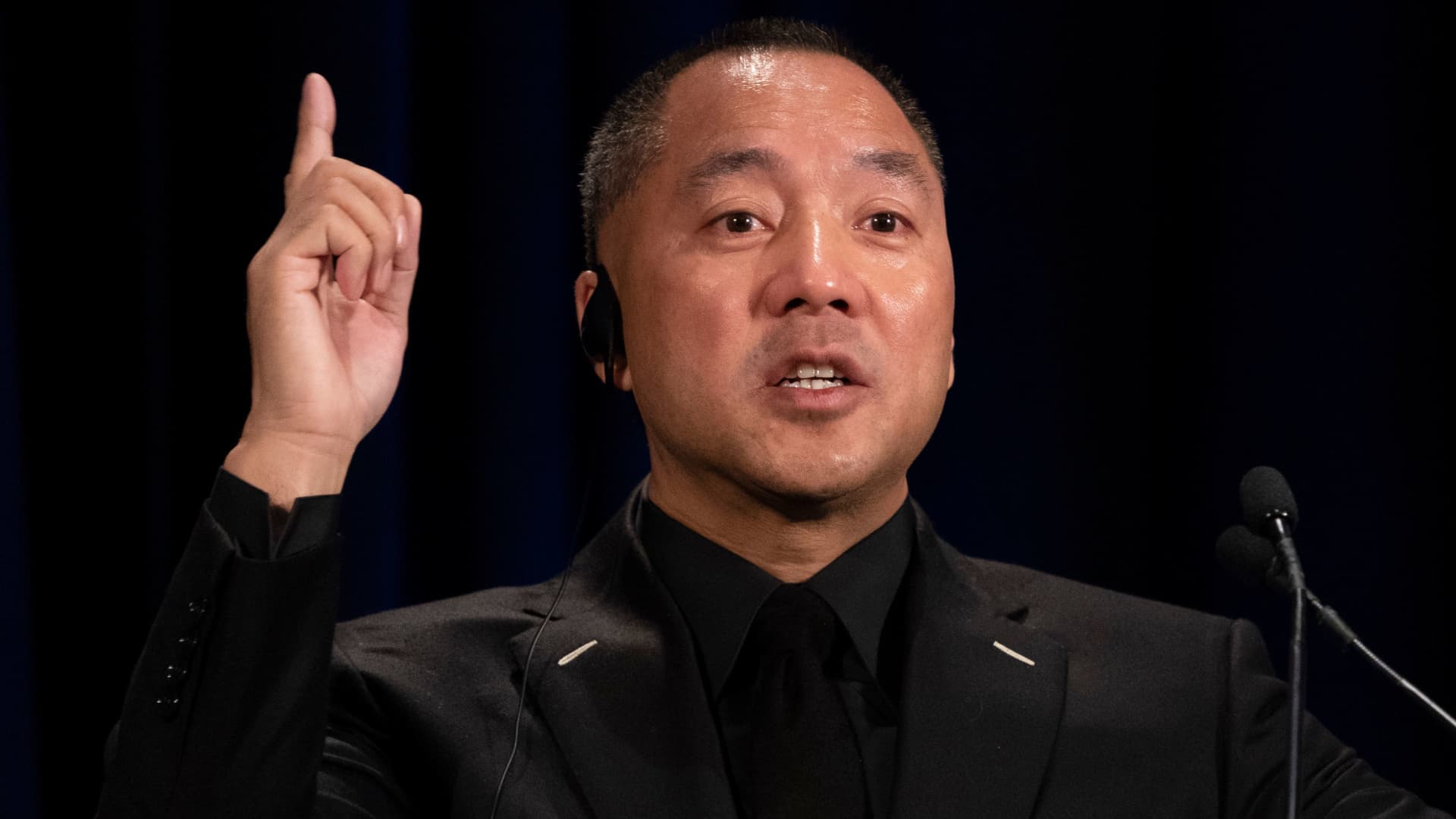

“With the goal of becoming a serial buyer, Tapestry wants to acquire Capri to further solidify its position in the fashion industry,” Henry Liu, director of the FTC’s Bureau of Competition, said in a statement.

At the heart of the F.TC’s concerns are “accessible luxury accessories” – an industry term for the cheaper goods sold by Coach, Kate Spade and Michael Kors. The agency said tens of millions of Americans could end up paying more for these items because the combined company would no longer have an incentive to compete on price.

“This deal threatens to deprive consumers of competition for affordable handbags, while hourly workers could lose the benefits of higher wages and more favorable working conditions,” Mr. Liu said.

A classic bag from Michael Kors, a Capri-based brand, such as a medium Marilyn logo tote bag, costs $228. Tapestry’s similar Coach Willow tote bag costs $350.

“It’s very clear to us that they don’t understand how consumers shop today and that they don’t understand the dynamics of a market with no barriers to entry and a constant influx of new competitors,” Tapestry CEO Joanne Crevoiserat said in an interview Monday.

Ms. Crevoiserat added that consumers can purchase bags from various retailers and numerous websites. “Type in ‘black tote bag,’ you’ll see thousands of choices and hundreds of brands at every price point,” she said.

She added that Tapestry remained focused on completing the deal this year and was prepared to defend it in court.

Capri said in a separate statement that it also disagreed with the FTC’s move and planned to defend the deal in court. The company said Americans have hundreds of options for where to buy handbags.

“The market realities that the government ignores in its lawsuit overwhelmingly demonstrate that this transaction will not restrict, reduce or restrict competition,” the statement said.

The fashion deal, announced in August, would create an American luxury group to compete with European majors such as Louis Vuitton’s parent company LVMH and Kering, the owner of Gucci. But it would pale in size comparison: Based on 2023 numbers, Capri, which owns Michael Kors as well as Versace and Jimmy Choo, and Tapestry, which owns Kate Spade and Stuart Weitzman as well as Coach, have a combined revenue of about $12 billion . LVMH had sales of 86.2 billion euros, or about $92.2 billion, last year.

The luxury market saw slower sales after benefiting from a pandemic boost in shoppers’ spending on handbags and other accessories. In February, Capri said quarterly sales fell 5.6 percent. That same month, Tapestry announced that it had achieved record sales for the quarter following a strong holiday.

The FTC has been reviewing the deal for months, even as regulators in the European Union and Japan approved it. Traders are increasingly betting against the likelihood of a breakout: Capri’s shares are down 25 percent this year, while Tapestry’s is up 6 percent. (Typically, the takeover target’s shares gain while the buyer’s shares fall.)

The FTC said that based on documents provided by Tapestry, Capri’s acquisition was unlikely to be the last and that this deal could give it leverage in future deals.

“This is the deal that makes sense for Tapestry,” Ms. Crevoiserat said. “That’s the transaction we’re focused on.”

Source link

2024-04-22 22:49:10

www.nytimes.com