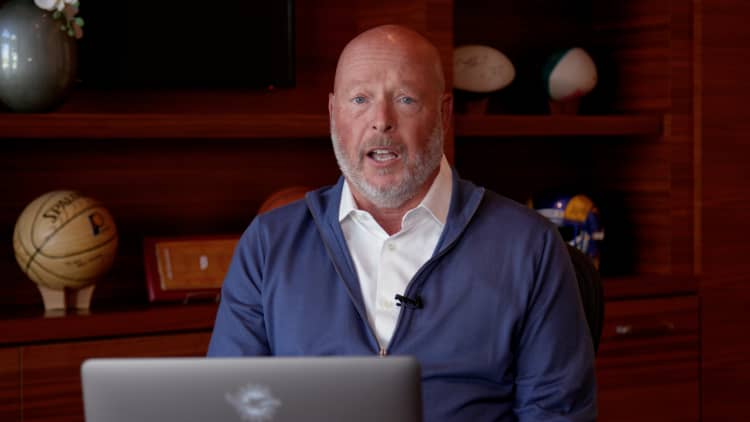

Michael Sonnenshein, CEO, Grayscale Investments on the NYSE, April 18, 2022.

Source: NYSE

LONDON – The boss of digital asset management firm Grayscale, which manages the $26 billion GBTC exchange-traded fund, has said fees on its flagship product will fall over time after outflows reached $12 billion.

Grayscale CEO Michael Sonnenshein said the crypto fund manager expects to reduce fees on its Grayscale Bitcoin Trust ETF in the coming months as the emerging crypto ETF market matures.

“I would like to confirm that over time as this market matures, GBTC fees will decrease,” Sonnenshein said in an interview with CNBC on Monday. The company previously defended its above-market fees.

“We’ve seen this in countless other deployments, countless other markets, etc., where typically products that are earlier in their lifecycle when they’re about to be relaunched are these [fees] tend to be higher. And as these markets mature and these funds grow, these fees will tend to decline, and we expect the same to be true for GBTC.”

According to data from crypto investment firm CoinShares, GBTC has seen outflows of more than $12 billion since it was converted into an ETF in early January, in no small part due to higher-than-average fees.

Data from CoinShares shows that GBTC saw its largest single daily outflow on Monday, with withdrawals totaling $643 million.

“Of course we expected outflows,” Sonnenshein told CNBC. “Investors either wanted to take profits from their portfolio, arbitrageurs wanted to exit the fund or liquidate positions that were part of bankruptcies through forced liquidation.”

Market commentators argue that the bankruptcy of crypto giant FTX played a major role in GBTC’s sell-off. FTX was a major owner of GBTC before it filed for bankruptcy in November 2022, holding approximately 22 million shares as of October 25.

According to reports from Bloomberg and CoinDesk in January, FTX’s bankruptcy estate has reportedly sold off the majority of its shares in Grayscale’s Bitcoin ETF.

“None of this was a surprise, right,” Sonnenshein said of the drains. “What we have seen is that GBTC continues to trade liquidly with tight spreads and across a very diversified shareholder base. So we believe we are between the first and second innings of this matter.”

“We’re kind of at the end of this first inning now, where hopefully the pent-up demand to buy has been satisfied and the pent-up demand to sell has hopefully been satisfied as well,” Sonnenshein added.

“And now we’re starting to move into the second and third innings, where there are so many more players in the market that don’t yet have access to these products.”

The crypto fund manager charges a 1.5% management fee for GBTC holders, which is significantly higher than the fee charged by many ETF providers, including BlackRock and Fidelity.

Read more about technology and crypto from CNBC Pro

Vanguard has completely waived fees for investors until March 2025 to attract deposits.

At the time, Grayscale’s Sonnenshein defended the company’s high fees, telling CNBC that they were justified by GBTC’s liquidity and track record. He said the reason other ETFs have lower fees is because their products “don’t have a track record” and issuers try to lure investors with fee incentives.

Sonnenshein said the reason other ETFs have lower fees is because the products “don’t have a track record” and issuers try to lure investors with fee incentives. “I think from our perspective this could sometimes call into question their long-term commitment to the asset class,” he said.

Sonnenshein told CNBC on Monday that “all of these new issuers have really come into the market to compete with us” and that they also compete with each other.

Grayscale is also looking to introduce other ways to give investors more cost-effective access to its Bitcoin ETF, including a “mini” version of its flagship product – the Grayscale Bitcoin Mini Trust, announced last week. The new ETF will trade under the ticker symbol “BTC” and will have a significantly lower fee than GBTC.

The new BTC ETF would effectively be spun off from the Grayscale Bitcoin Trust ETF and would feature an as-yet undisclosed portion of the underlying Bitcoin GBTC shares.

Under this structure, existing GBTC holders could benefit from a lower overall fee while maintaining the same exposure to Bitcoin, which includes ownership of GBTC and BTC shares.

Existing GBTC shareholders could also convert into BTC without paying capital gains tax.

The company is currently awaiting approval of its Bitcoin Mini Trust ETF from the US Securities and Exchange Commission.

Moving forward, Sonnenshein wants investors to turn their attention to the company’s other crypto investment products, which track the prices of various cryptocurrencies, including Ether and Solana.

The company is trying to convert its Grayscale Ethereum Trust into an ETF but is awaiting SEC approval.

Source link

2024-03-19 10:35:52

www.cnbc.com