Paramount’s planned merger with Skydance was the most turbulent media deal in years. Now things have taken another turn after the exclusivity period for negotiations expired without an agreement being reached.

A month ago, a special committee of Paramount’s board agreed to enter into exclusive talks with Skydance – a Hollywood studio owned by tech scion David Ellison – despite a $26 billion offer from private equity giant Apollo Global Management. Paramount shareholders complained that granting exclusivity was a mistake and that the company should have partnered with Apollo instead.

This week the special committee informed Skydance that it was letting the exclusivity period expire. The end of exclusivity does not alone destroy the deal with Skydance. But it does allow Paramount to begin negotiations with Apollo and Sony Pictures Entertainment, which have signed on to Apollo’s bid.

The so far inconclusive negotiations raise a question that dealmakers have long debated: Why do companies like Paramount agree to exclusivity at all?

Buyers often prefer exclusivity more than sellers. Exclusivity is a sign from the seller that they are committed to closing a deal and not just bidding to get higher offers.

Sellers generally prefer to negotiate without exclusivity because it limits their ability to get a higher price. And because they have already signaled to a buyer that they are willing to do a deal, they have weakened their bargaining power.

Many large transactions with public companies are negotiated without exclusivity because shareholders expect the company to receive the highest possible price.

Exclusivity can help sellers with tricky deals. Requiring you to negotiate with only one party not only helps persuade a potential buyer to spend millions on due diligence, but can also obscure limited interest.

“An auction is a really good way to sell something when you have multiple bidders,” Edward Rock, a corporate law professor at New York University, told DealBook. “It’s a really bad way to sell something if you announce an auction and only one person shows up, because now everyone knows there’s no one else interested in buying the company.”

Other factors were most likely at play for Paramount. Shari Redstone, the company’s chief executive, almost certainly favors a Skydance deal that would allow her to sell her shares at a control premium. It’s unclear whether Paramount’s cash offer from Sony and Apollo would be just as lucrative for them.

Redstone appointed the special committee to lead Paramount’s negotiations to avoid conflicts of interest. However, the committee understands that Skydance’s bid for National Amusements, Paramount’s parent company, was supported by Redstone, the company’s most influential shareholder. That was likely a factor in the decision to move forward with exclusive talks, said Steven Davidoff Solomon, a professor at the University of California, Berkeley, School of Law.

Solomon said the select committee may have viewed Skydance’s offer as the only plausible deal on the table. “Let’s see if we can do it,” Solomon said, offering his interpretation of the committee’s approach. “If we don’t make it, we can do another deal 30 days later.”

But time is money. The highly publicized 30-day deadline thrust the deal into the spotlight and added an unwanted level of drama as the two sides tried to negotiate a tricky agreement. The 30 days also coincided with the departure of Paramount CEO Bob Bakish, leaving the company on shakier ground and potentially weakening its bargaining power.

If Paramount enters into talks with Sony and Apollo, it’s not clear whether they will result in a deal. It is unclear whether there will even be a deal. But in any case, Paramount’s special committee will have a lot to discuss when it meets today to discuss its options. —Lauren Hirsch

IN CASE YOU MISSED IT

The United States added fewer jobs than expected last month. Nonfarm payrolls released this week showed 175,000 jobs were added, fewer than forecast, and wage growth slowed. The data capped a week of new economic indicators and the Fed’s decision to keep interest rates unchanged until it is confident that inflation is closer to its 2 percent target.

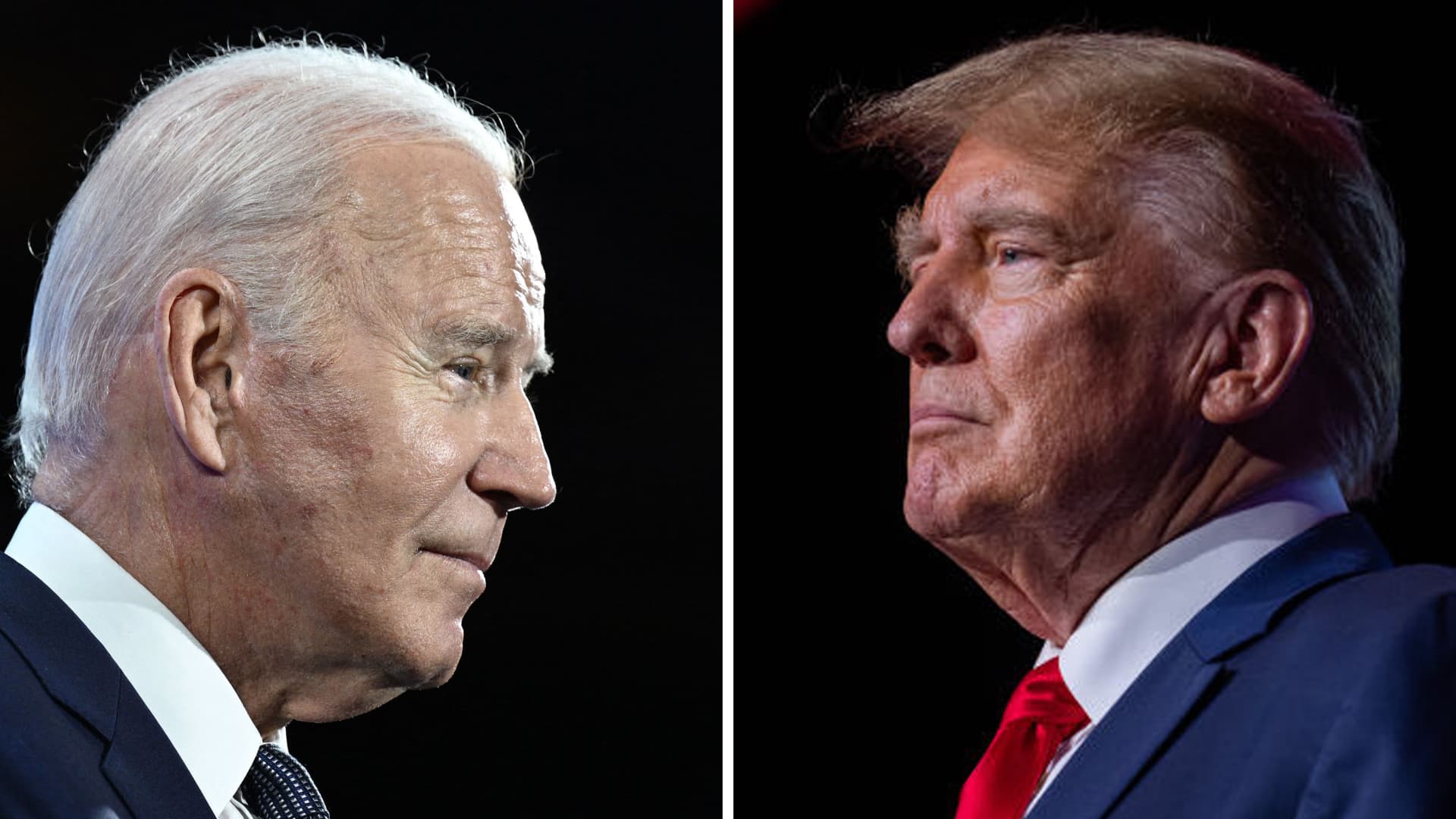

The Securities and Exchange Commission accused Trump Media’s auditor of fraud. The regulator accused BF Borgers of failing to comply with accounting rules and the company agreed to stop submitting audited statements on behalf of customers. Trump Media has been a customer of BF Borgers since 2022.

The Biden administration recommended reclassifying marijuana. Cannabis company stocks jumped on news that the Justice Department had recommended changing the drug’s classification from Schedule I (the same level as heroin) to Schedule III (which would put it on par with Tylenol and codeine). The move could help President Biden appeal to younger voters.

Another crypto mogul has been sentenced to prison. Changpeng Zhao, the founder of Binance and one of the biggest names in the industry, was sentenced to four months in prison for money laundering. Zhao, who pleaded guilty last year, received less than the three-year sentence recommended by prosecutors. With an estimated fortune of $33 billion, he could become the richest federal inmate in U.S. history.

Munger’s best zingers

Much of Berkshire Hathaway’s annual meeting in Omaha today will resemble gatherings of years past: the tens of thousands of attendees from around the world; Dozens of representatives from the conglomerate’s portfolio companies, from Fruit of the Loom to BNSF Railroad; and Warren Buffett himself was available to answer questions from shareholders.

But this year Buffett will be without his longtime right-hand man Charlie Munger, who died in November at age 99. For a long time, the heart of the shareholder conclave was an hour-long question-and-answer session with the two men perfecting a buddy comedy act – Buffett first responded with sunny optimism, and then Munger followed with sharp-tongued cynicism. (This year, Buffett will be accompanied by his top lieutenants Greg Abel and Ajit Jain.)

Here are some of the best sayings Munger has expressed at Berkshire’s annual meetings over the years:

-

“When you mix the mathematics of the chain letter or the pyramid scheme with a legitimate development like the development of the Internet, you are mixing something that is pathetic or irrational or has bad consequences with something that has very good consequences.” But you know, if If you mix raisins with feces, it’s still feces.” (2000)

-

“To get ahead, I had to compete against idiots. And luckily there is a large supply.” (2014)

-

“I have avoided compensation consultants my entire life. I can hardly find the words to express my contempt.” (2017)

-

“A man jumping out of a building is OK until he hits the ground.” (2023, on government deficits)

On our radar: AI art that gives people hope

Since ChatGPT was released in 2022, companies and governments have been trying to figure out how artificial intelligence will work with humans. Can technology take over entire tasks? Is it an employee? And which functions could AI complement rather than replace?

To get clues about the future, DealBook visited two art galleries in London that featured works by traditional artists experimenting with AI

In “AI & Technology Influence on Contemporary Art,” an exhibition curated by Virginia Damtsa and on view at Gabriel Scott through September 10, three painters have used technology to test the limits of human creativity and examine whether AI is a is a liberating tool or an existential risk for creativity. Jonathan Yeo – whose painting of King Charles III, the first since his coronation, will be unveiled this month – asked an AI to create a series of self-portraits. Von Wolfe, an oil painter, built his own AI to create an image of a digital sculpture displayed in a lightbox. And Henry Hudson asked an AI to create an image and then painted a version of it with oil paints.

“Post-Photography: The Uncanny Valley,” an exhibition at the Palmer Gallery through May 17, also features the work of three artists. Germany’s Boris Eldagsen won a Sony World Photographer Award last year – and turned it down after revealing he had used AI to create his piece, in part to spark discussion about technology and art. The painting “The Electrician” and other works by Eldagsen will be shown alongside images by Ben Millar Cole, a British photographer, and Nouf Aljowaysir, a Saudi-born artist. It would be impossible for most viewers to know that the images were created using tools like DALL-E, Midjourney and Stable Diffusion.

The artists created the works using AI as a tool, as if it were a brush or a computer. For workers who want to understand how their own work will evolve, this could give hope that people will continue to play a role for a while.

Thank you for reading! I’ll see you on monday.

We appreciate your feedback. Please email your thoughts and suggestions to dealbook@nytimes.com.

Source link

2024-05-04 12:16:55

www.nytimes.com