Mosaic Insurance Introduces New Political Risk Offering for US Market | Insurance business America

The product is intended to reduce the risk of non-payment in connection with arbitration awards

Insurance News

By Mika Pangilinan

Mosaic Insurance has announced the expansion of its political risk coverage into the US market with the launch of an Arbitration Award Default Insurance (AADI) product.

The new offering is intended to reduce the risk of defaults related to arbitration awards, particularly in high-risk disputes or in situations where a state has a history of financial defaults.

It also aims to reduce uncertainty for plaintiffs and litigation funders and enable companies to monetize potential income from arbitration awards.

In addition, it provides comprehensive award value coverage to protect against administrative and financial losses during arbitration or enforcement proceedings.

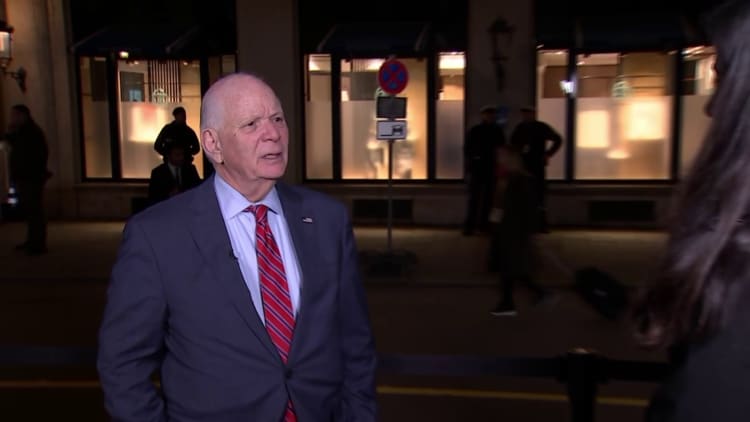

“Arbitration default insurance is revolutionizing the landscape for plaintiffs, law firms and litigation funders involved in international arbitration,” said Tamar Katamadze (pictured), who has been appointed to lead the product for Mosaic’s political risk department.

“This solution provides clients with the ability to manage both maturity and liquidity risks at every stage of the arbitration process or when recognizing and enforcing arbitral awards.”

Finn McGuirk, global head of political risk, also highlighted the relevance of AADI amid “geopolitical and economic turmoil.”

“AADI is an increasingly relevant product that protects investors from sovereign defaults and enforcement risks as they navigate the complexities of claims in international arbitration,” he said. “We are pleased to be able to offer this innovative coverage in our product portfolio.”

According to a company release, Mosaic’s AADI covers both pre-award and post-award scenarios. It has a capacity of $65 million per risk with a term of five years, which can be extended on a case-by-case basis.

What do you think about this story? Feel free to share your comments below.

similar posts

Stay up to date with the latest news and events

Join our mailing list, it’s free!

Source link

2024-03-28 15:48:06

www.insurancebusinessmag.com