The country’s millionaires and billionaires evade more than $150 billion in taxes annually, leading to growing federal deficits and a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

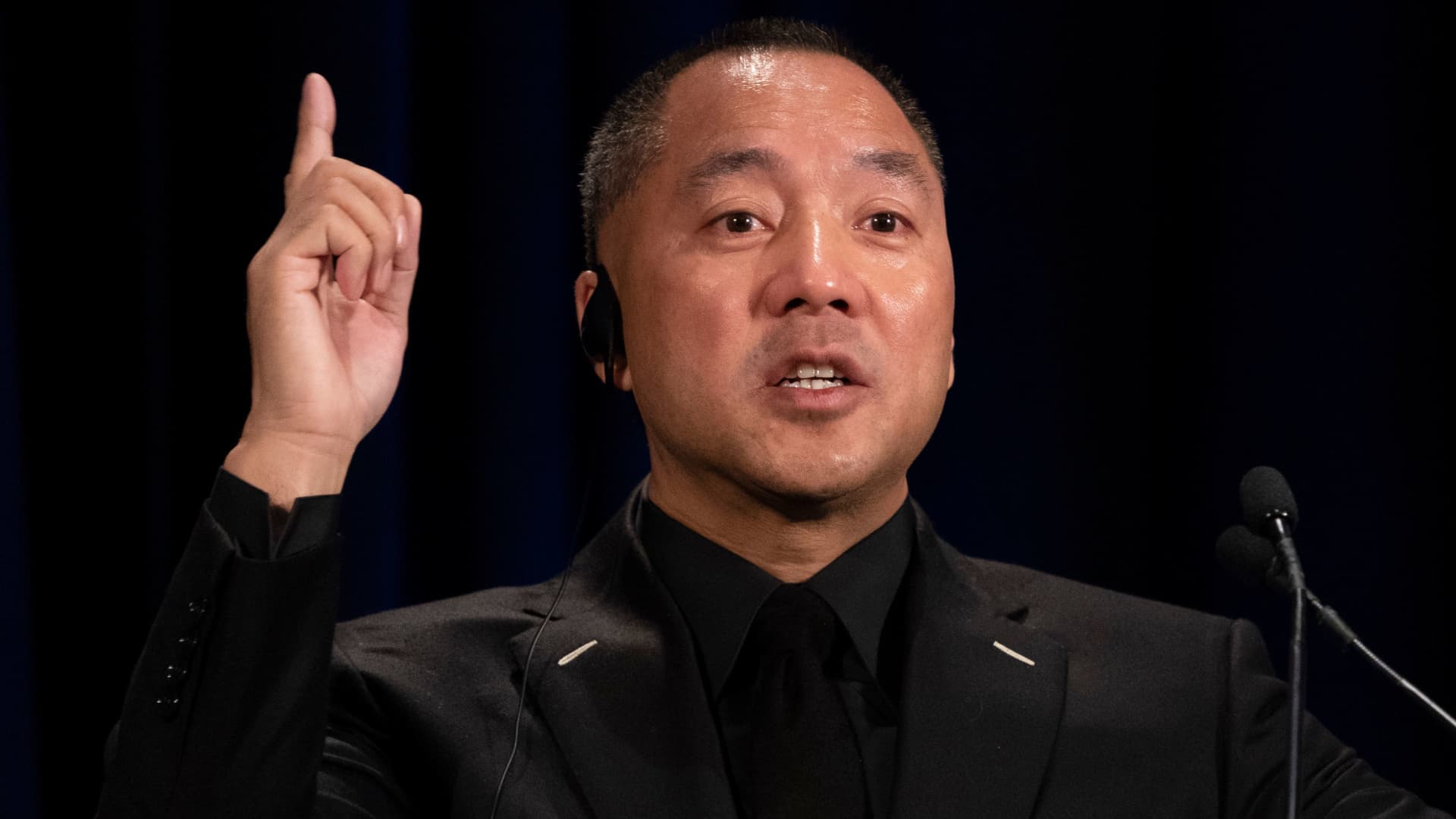

The IRS has launched a sweeping crackdown on wealthy taxpayers, partnerships and large corporations with billions of dollars in new funding from Congress. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs aimed at taxpayers with the most complex tax returns to root out tax evasion and ensure every taxpayer contributes their fair share.

“When I look at what we call our tax gap, the amount owed versus what is paid for, I see millionaires and billionaires who either don’t file taxes or… [are] “If we don’t report their income, that’s $150 billion of our tax gap,” Werfel said. “Its a lot to do.”

Werfel said that for years the IRS has lacked the staff, technology and resources to fund audits — particularly on the most complicated and demanding tax returns, which require more resources. According to IRS statistics, audits of taxpayers earning more than $1 million a year have fallen by more than 80% over the past decade, while the number of taxpayers making more than $1 million has increased by 50% is.

“With complex filings, it became increasingly difficult for us to determine the balance due,” he said. “To ensure justice, we must make investments to ensure that whether you are a complicated actor who can afford to hire an army of lawyers and accountants or a simpler actor who only has one income and the Taking the standard deduction, which… The IRS can equally determine what we are owed. This is a fairer system.”

Some Republicans in Congress have stepped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and will fail to increase promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion cash injection, but Republicans in Congress reached a deal last year to claw back $20 billion of the funding. Now they are pushing for further cuts.

The Treasury Department said last week that it expects stronger IRS enforcement to result in $561 billion in additional tax revenue between 2024 and 2034 – a higher forecast than originally stated. The IRS says that for every additional dollar spent on enforcement, the agency generates about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who had failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group, “and we’re continuing,” Werfel said.

Internal Revenue Service (IRS) Commissioner Danny Werfel speaks after his swearing-in ceremony at IRS headquarters in Washington, DC, USA, on Tuesday, April 4, 2023.

Ting Shen | Bloomberg | Getty Images

On Wednesday, the agency announced a program to audit private jet owners who may use their planes for personal travel and fail to properly account for their travel or taxes. Werfel said the agency has begun using public databases of private jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is conducting dozens of audits of companies and partnerships that own jets, which could then lead to audits of high-net-worth individuals.

Werfel said the corporate jet tax deduction could amount to “tens of millions of dollars” for some companies and owners.

Another area where tax evasion may occur, according to Werfel, is limited partnerships. Many wealthy individuals shifted their income to corporations to avoid income taxes.

“We started to see certain taxpayers demanding limited partnerships even though it wasn’t fair,” he said. “They essentially shielded their income under the guise of a limited partnership.”

The IRS has created the Large Partnership Compliance Program, which examines some of the largest and most complicated partnership returns. Werfel said the IRS has already initiated audits of 76 partnerships – including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and other programs to better identify returns that are most likely to contain fraud or errors. AI not only helps detect tax evasions, but also helps avoid audits on taxpayers who follow the rules.

“Imagine all the audits are on a table in front of us,” he said. “AI allows us to put on night vision goggles. These night vision goggles allow us to find out more precisely where the high risk lies.” [of evasion] and where the risk is low, and that benefits everyone.”

Correction: The IRS collected $480 million from a group of millionaire taxpayers who had defaulted on payments. A previous version incorrectly stated the amount collected.

Source link

2024-02-22 19:13:29

www.cnbc.com