The inaugural flight of an Avelo Airlines Boeing 737-800 takes off from Hollywood Burbank Airport to Charles M. Schulz-Sonoma County Airport in Santa Rosa on April 28, 2021.

Patrick T Fallon | AFP | Getty Images

In the nearly four years since the Covid-19 pandemic upended air travel, the largest U.S. airlines have returned to profitability. The CEOs of two emerging airlines founded in the middle of the pandemic say they are close to joining them.

Avelo and Breeze Airways, two low-cost airlines that debuted in 2021 when demand for air travel in the U.S. was more than 30% below pre-pandemic levels, have both quickly expanded their operations.

They have launched dozens of new routes across the country, and their founders say their strategy of connecting cities where there is less competition from major airlines is paying off. Think Hollywood Burbank Airport in Los Angeles, not Los Angeles International or Islip on Long Island via New York City.

“When there are Goliaths and you’re just David, it’s really hard,” said Avelo Airlines CEO Andrew Levy.

Delta, American, United And southwest According to Cirium, together they control about three-quarters of the US market.

Avelo says it flew 2.3 million passengers in 2023 and that its aircraft were more than 80% full on average. According to the company, Breeze carried more than 2.8 million travelers last year and its flights were 77% full. The straps are still tiny. By comparison, Southwest Airlines, the largest domestic airline, carried more than 137 million passengers last year.

Still, Avelo reported its first profitable quarter in the final three months of 2023, and a company spokesman said the airline would likely turn an annual profit in 2024. For full-year 2023, it reported revenue of $265 million, up 74% year over year.

Levy said he had expected the airline to turn a profit sooner, but high fuel costs at a time of high inflation and Russia’s invasion of Ukraine two years ago pushed back the schedule.

Breeze is also on track for its first profitable year in 2024, said CEO David Neeleman.

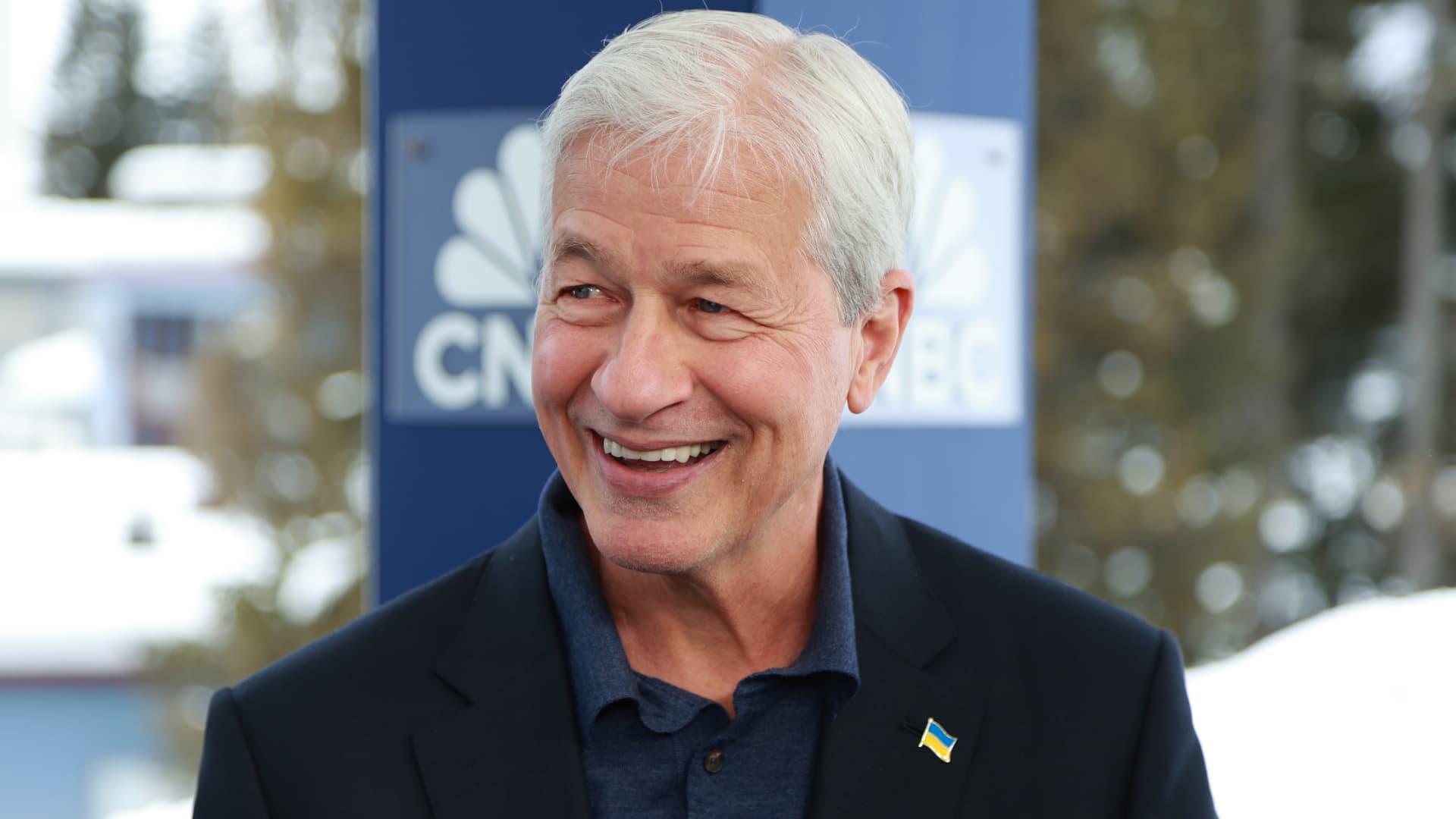

David Neeleman, founder and CEO of Breeze Airways, before boarding the airline’s inaugural flight at Tampa International Airport on May 27, 2021 in Tampa, Florida.

Matt May | Bloomberg | Getty Images

Typically, it takes airlines two to four years after launch to start turning a profit, said Henry Harteveldt, president of Atmosphere Research Group, a travel industry consulting firm. Avelo and Breeze each faced additional challenges that weighed on the entire industry, including a rise in oil prices, supply chain issues and a shortage of pilots and air traffic controllers.

“The fact that both airlines are still operating is a credit [Levy’s and Neeleman’s] Visions, their leadership, but also the commitment of their employees,” said Harteveldt.

Skip hubs

Both airlines have staked a claim in the low-cost carrier segment, which includes Border And loyaltywhich offer basic fares, additional fares and secondary airport flights.

Avelo flies to approximately 50 destinations and operates from six bases, including Tweed-New Haven Airport in Connecticut and Wilmington Airport in Delaware. Many of its destinations range from the Northeast to popular vacation destinations in Florida and South Carolina, but it also serves destinations in California and other western states in the United States

The airline expanded beyond the continental U.S. in 2023 when it introduced service to Puerto Rico and is expected to expand to international destinations this year, Levy said.

Breeze, which Neeleman founded after he also started JetBlue Airways and Brazilian airline AzulFor the most part, it avoids large hubs and flies from about 50 airports, including New York’s Westchester County Airport and Akron-Canton Airport in Ohio.

It flies to standard vacation destinations, but also offers cross-country flights from cities like Hartford, Connecticut or Charleston, South Carolina, to destinations like Las Vegas and Los Angeles. It is hoped to start international service by 2025.

Both Avelo and Breeze continued to announce new routes and destinations this year. Avelo had 11 routes shortly after launching in summer 2021 and now has about 75, while Breeze flew about 16 routes this summer and currently sells about 180.

A Breeze Airways aircraft on the tarmac at Tampa International Airport in Tampa, Florida, on May 27, 2021.

Matt May | Bloomberg | Getty Images

Breeze and Avelo sell basic fares – sometimes even in the double digits – and charge fees for checked baggage and advanced seat assignments, surcharges that are common not only on budget airlines but also on most major airlines.

Breeze’s cheapest fare option only allows travelers to take one personal item with them, but the airline also offers first class seats and options with more legroom and amenities. The basic fare for both airlines does not include hand luggage.

operating cost

Offering low airfares has made the industry-wide cost increases for Avelo and Breeze all the more daunting. One challenge, for example, was the nationwide shortage of pilots as a result of the pandemic and rising labor costs.

Major airlines, which can offer high salaries to their pilots, have poached pilots from smaller airlines in recent years to bolster their staffing following the pandemic.

“What you should really watch for among pilots is turnover. … We had a turnover rate that was higher than we would have liked, and now it’s where we want it to be,” Neeleman said.

The airline has many first officers who are close to being promoted to captain to ease the shortage, he added.

Airlines also struggled with delayed aircraft deliveries and difficulties obtaining thousands of spare parts.

Andrew Levy, founder, chairman and CEO of Avelo Airlines, speaks at Hollywood Burbank Airport on April 7, 2021 in Burbank, California.

Joe Scarnici | Getty Images

Avelo has been struggling with delays in deliveries of its used Boeing 737 aircraft that it has leased, CEO Levy said. The company currently has 16 aircraft in its fleet and has five on order.

“The entire aviation supply chain system has been thrown into disarray since Covid. And it’s still not quite what it was,” Levy said.

Breeze announced last month that it would exercise options on 10 additional Airbus A220 aircraft. The company will exclusively fly the A220 for its commercial service until the end of 2024. The company currently flies 22 A220s and will have 32 in service by the end of 2024, Neeleman said.

Neeleman said Breeze aims to be profitable before deciding on an IPO or other option. Avelo also hopes to achieve sustained profitability before an IPO.

Levy said that Avelo’s focus was on “getting to a point where the company is ready to go public” and that he had no interest in selling the company.

Some airlines, particularly low-cost carriers, have sought mergers in recent years to weaken the dominance of the big four carriers. JetBlue and Spirit announced plans to combine in July 2022 that would have created the fifth-largest airline in the U.S., although a federal judge blocked that merger in January. These airlines have appealed this ruling.

Hawaiian Airlines And Alaska Airlines are planning a merger, but will continue to operate the brands as independent carriers.

Both Levy and Neeleman said there is room for multiple players in the low-cost carrier space.

“The more competition we have in the U.S. airline industry, the better it is for the traveling public,” said Harteveldt of the Atmosphere Research Group.

—CNBC’s Leslie Josephs contributed to this report.

Don’t miss these stories from CNBC PRO:

Source link

2024-03-02 13:00:01

www.cnbc.com