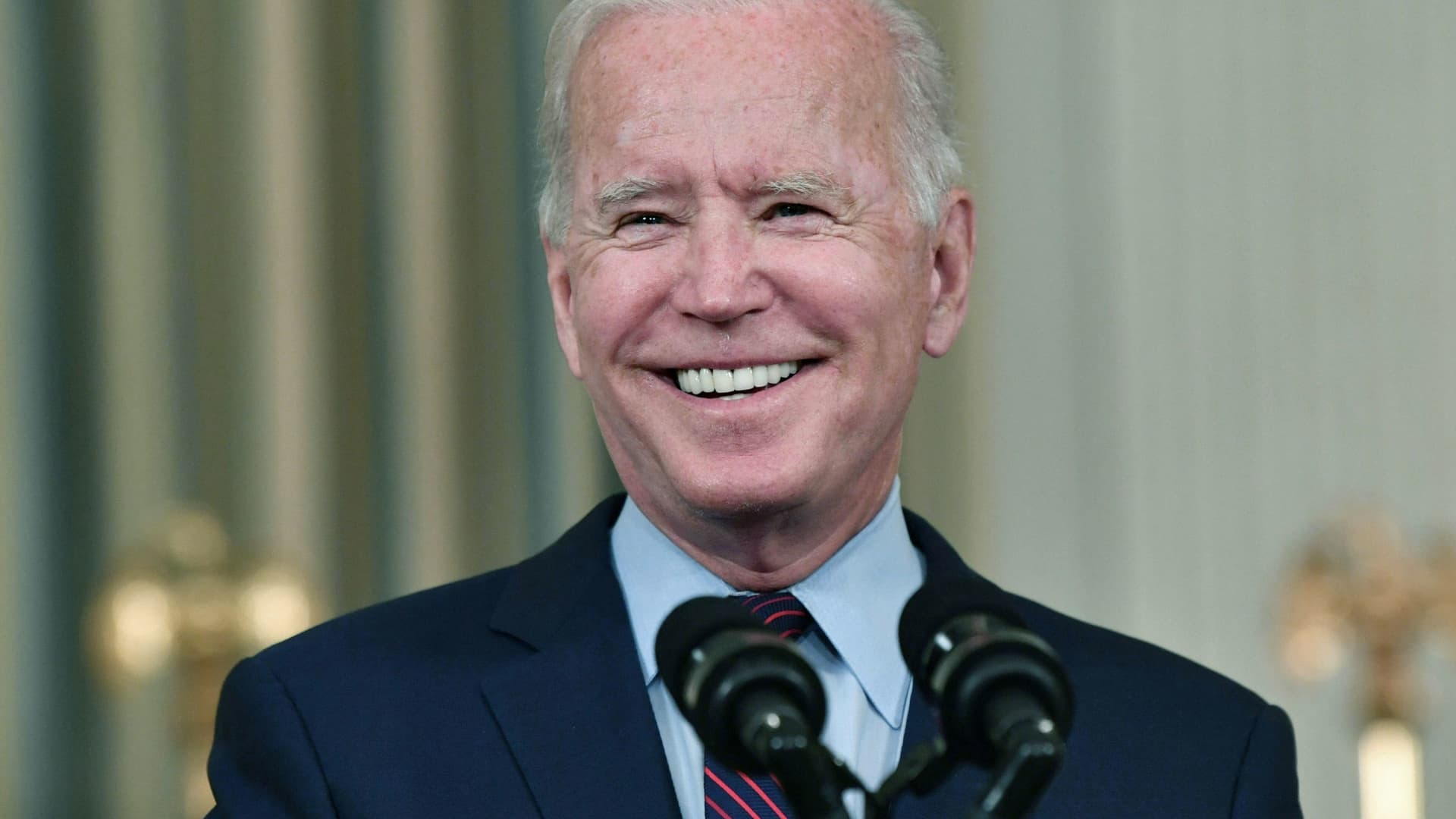

President Biden announced a major effort Monday to help pay off federal student loans for tens of millions of American borrowers, seeking an election-year boost by returning to a 2020 campaign promise that was blocked by the Supreme Court last year.

Mr. Biden’s new plan would reduce the amount that 25 million borrowers still owe on their bachelor’s and master’s loans. It would wipe out the entire amount for more than four million Americans. In total, White House officials said, 10 million borrowers would receive debt relief of $5,000 or more.

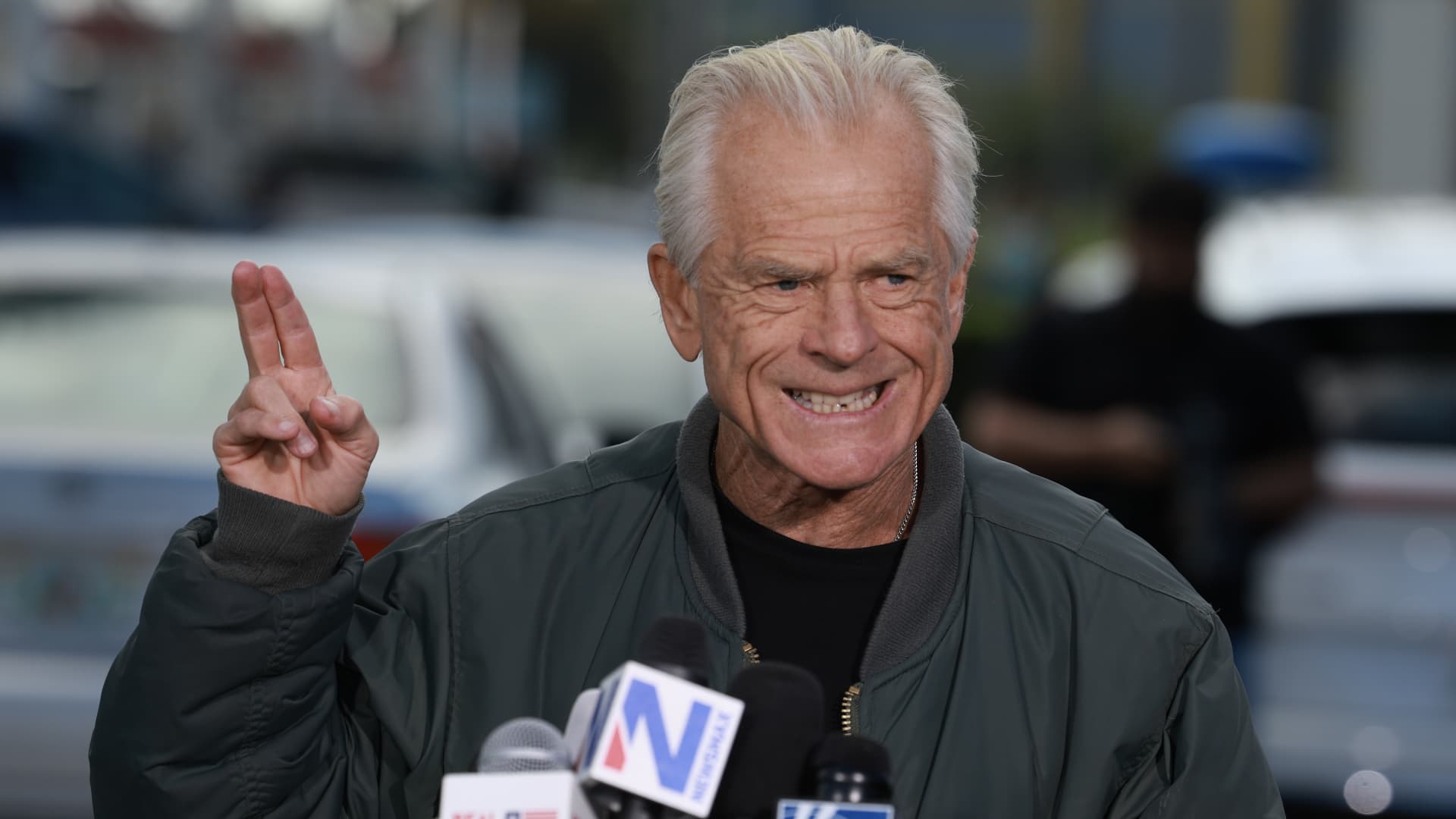

“While a college degree is still a ticket to the middle class, that ticket is becoming far too expensive,” Mr. Biden said during a speech to a small but enthusiastic audience full of supporters. “Today, too many Americans, especially young people, are burdened with too much debt.”

Mr. Biden announced the plan in Madison, Wisconsin, the capital of a critical swing state and college town that symbolizes the president’s promise to make higher education affordability a cornerstone of his economic agenda.

But it’s a promise he has so far failed to keep, largely because of legal challenges from Republicans and other critics. They accuse Mr. Biden of unlawfully using his executive power to initiate a costly transfer of wealth from taxpayers who did not take out federal student loans to those who did.

Officials did not say how much the new plan would cost in coming years, but critics said it could increase inflation and add billions of dollars to the federal debt.

Mr. Biden said his new efforts would help the economy by removing the burden of enormous debt on people who would otherwise be unable to buy a home or pursue a more economically healthy future.

“We’re giving people the chance to get it done,” Mr. Biden said. “No guarantee. Just one chance to make it.”

Mr Biden’s announcement was an overhaul of the president. In the summer of 2022, he launched a plan to relieve about 43 million borrowers of $400 billion in student debt. This was blocked by the Supreme Court on the grounds that he had exceeded his authority. In the months since, Mr. Biden has canceled small amounts of debt using existing programs. But now he’s making a larger attempt that’s closer to the scale of his first attempt.

The original plan relied on a law called the HEROES Act, which the government believed would allow the government to waive student debt during a national emergency like the Covid pandemic. The justices disagreed after Republican attorneys general and others challenged the debt relief plan.

The new approach is different.

For months, Mr. Biden’s Education Department has been developing regulations through a lengthy process authorized by the Higher Education Act. Instead of blanket debt relief, the new approach targets five groups of borrowers: those whose loans have ballooned because of interest rates; borrowers who have been paying for decades; those in economic distress; Individuals who qualify for existing debt relief programs but have not applied; and those whose loans came from schools that have since been denied certification or are no longer eligible for federal student aid programs.

Administration officials said the new approach is more likely to overcome expected challenges because it is based on a different law. They said White House and Education Department lawyers studied the Supreme Court’s ruling and designed the new program so that it would not violate the principles outlined by the justices.

But lawyers for those who oppose this approach are likely to argue that debt relief would be unfair to those who have already paid off their loans or never taken out student loans at all. This argument helped convince the judges in the final case.

Neal McCluskey, director of the Center for Educational Freedom at the Cato Institute, called the new plan a “dangerous policy” that would be unfair to taxpayers and cause colleges and universities to raise their prices.

“The Constitution gives Congress, not the President, the power to make laws, and the Supreme Court has already rejected unilateral, mass student debt relief by the Biden administration,” he said. “It would saddle taxpayers with bills for debt that other people have chosen for their own financial advancement.”

Resolving the legal challenges will likely take months, and that could leave the debt relief plan in limbo as voters go to the polls in November to choose between Mr. Biden and former President Donald J. Trump.

Members of Mr. Biden’s administration gathered across the country on Monday to talk about the new plan, betting that it will attract support from voters who were disappointed that the court would have blocked the first plan, which included debt of up to $20,000 for ten years would have been eliminated from millions of borrowers. Vice President Kamala Harris held a panel in Philadelphia. Miguel Cardona, the education secretary, spoke in New York City.

But beyond the threat of legal action, the president faces major obstacles based on the calendar alone. The new plan has not yet been published in the Federal Register, beginning a required months-long public comment period before it can take effect. Officials said Sunday only that they hoped some of the provisions would take effect in the “early fall” of this year.

Administration officials hope the president’s supporters will give him credit for trying, even if many of the borrowers end up feeling no relief before they go to the ballot box.

Sen. Chuck Schumer, Democrat of New York and majority leader, said the president’s announcement underscored the difference between Republicans and Democrats when it comes to the issue of economic support for those struggling the most.

“After the MAGA Supreme Court struck down the most far-reaching student loan debt relief last year, taking away a financial lifeline from those who need it most, this new action from President Biden shows that Democrats are committed to making improvements to the federal student loan program Higher education can finally be a ticket to the middle class for everyone,” he said in a statement.

White House officials have been scrambling for months to respond to the president’s supporters’ anger over student loans. In a survey released last month, more than 70 percent of young people said the issue of student loan forgiveness was “important” or “very important” to them in their decision in the 2024 election campaign.

Officials said the five groups of people targeted by the new plan will address most of the serious problems some borrowers have with their student loans.

Individuals whose loans have grown due to interest beyond the amount they originally borrowed would see up to $20,000 of that interest eliminated, leaving them only required to repay the amount they originally borrowed. Individuals earning less than $120,000 a year or couples earning less than $240,000 are eligible to have all interest forgiven.

Officials said 23 million people would most likely be exempt from this provision on their entire interest-related balances.

About two million borrowers who are already eligible for student loan forgiveness under existing programs have not applied for relief. Under the new rules, the Education Department would have the authority to forgive these people’s debts without them having to apply.

People who took out federal student loans for bachelor’s degrees and began repaying them more than 20 years ago will have their debt automatically forgiven under the new plan. Graduate students who borrowed money 25 years ago and started paying it back would have their debt forgiven.

Officials said about 2.5 million people would be covered by this rule.

People who borrowed money to attend colleges that have since lost their certification or eligibility to participate in the federal student aid program would have their debt forgiven. Officials did not say how many people would be affected. And people who are particularly burdened with other expenses — such as high medical debt or child care — could apply for student loan forgiveness.

Officials did not estimate how many people might be eligible for the so-called “hardship programs.”

Source link

2024-04-08 20:00:59

www.nytimes.com