Mohamed Aly El-Erian, Chief Economic Advisor at Allianz SE.

Bloomberg | Getty Images

The US Federal Reserve has become too dependent on data and has lost sight of its overall strategy, Mohamed El-Erian, Allianz’s chief economic adviser, said on Friday.

The economist told CNBC that a longer-term, more strategic perspective could lead policymakers to agree on a new inflation target closer to 3%.

“Instead of being strategic, this Fed has become overly data-dependent and has become a selective commentator,” El-Erian told CNBC’s Steve Sedgwick at the Ambrosetti Spring Forum in Italy.

“That’s not the Fed’s role,” he continued. “The Fed should be strategic, the Fed should provide a strategic anchor, a stabilizer.”

“The mistake they could make is that they go too tight this time,” he said.

The Federal Reserve did not immediately respond to a CNBC request for comment.

El-Erian’s comments follow a recent chorus of Fed policymakers who have begun talking conservatively about cutting interest rates.

Fed Chairman Jerome Powell said on Wednesday that the bank needed more evidence to assess the current inflation situation, casting doubt on expectations of a rate cut in June.

A day later, Neel Kashkari, president of the Minneapolis Fed, said he questioned whether the central bank should cut interest rates at all if inflation remained stubborn and markets collapsed.

El-Erian said the comments were an example of the Fed “overreacting to data” and said it should look at the economy more holistically.

However, he noted that policymakers’ hawkish approach could be an indication that they are considering the possibility of a new normal inflation target.

“The way you politely discuss this is that you don’t say, ‘Let’s change the inflation target,’ but rather, ‘Let’s get to 2% somewhere in the future. Let’s chart a course,’” El-Erian said. “It may well prove that the economy is stable at somewhere near 3%. I don’t think this will weaken inflation expectations,” he added.

To push inflation back toward its target, the Fed has raised interest rates a total of 11 times in recent years to a target range of 5.25% to 5.5% – the highest level in more than 22 years.

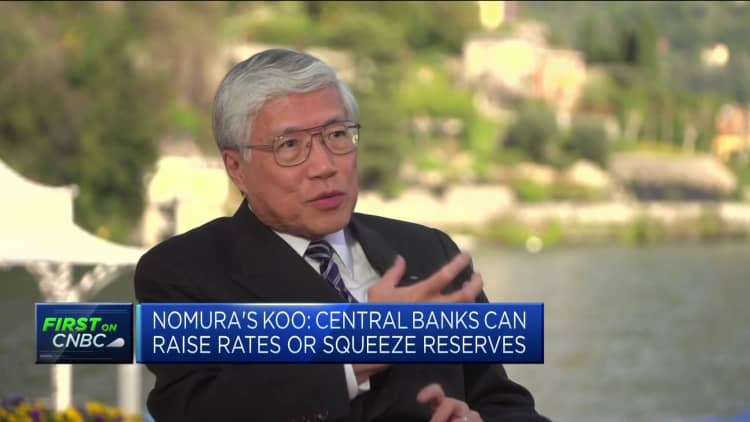

According to Richard Koo, chief economist at Nomura Research Institute, the Fed’s target has proven particularly challenging given current high U.S. bank reserves.

In past monetary tightening cycles, central banks have reduced bank reserves to further reduce inflation. But given current US reserves, which are around 1,700 higher than before the Lehman crisis in 2008, this path is unfeasible, according to Koo.

“If you tried to tighten monetary policy with this tool, you must first remove the $3.2 trillion before taking control of the situation. And of course you can’t do that overnight,” Koo said at the same event on Thursday.

“A lot depends on interest rates, and interest rates need to go much higher to have the same effect they had before excess reserves reached this level,” he added.

Source link

2024-04-05 10:39:14

www.cnbc.com