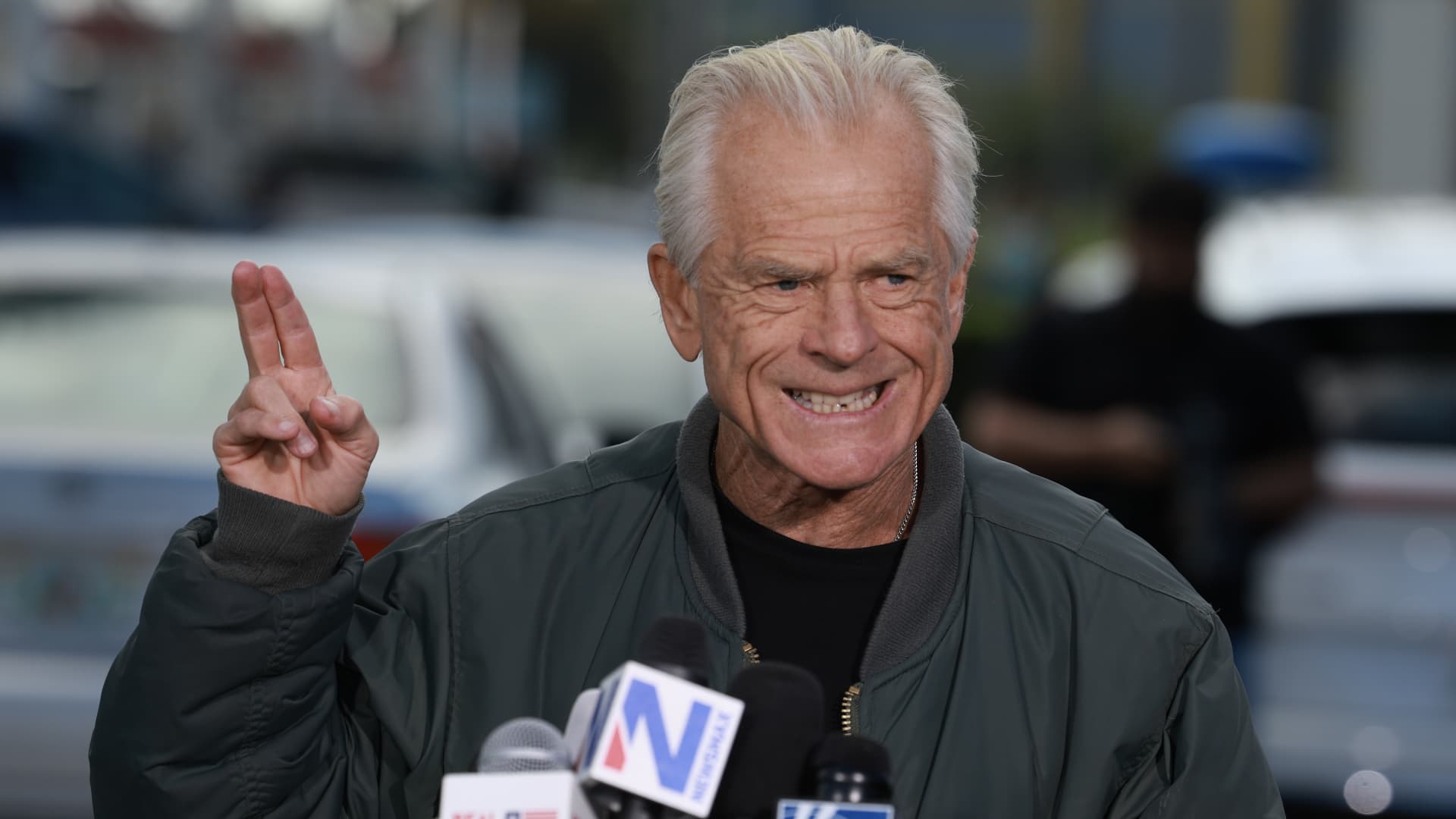

Financial Advisor and Director of the Department of Monetary and Capital Markets, Tobias Adrian, delivers the press conference on the Global Financial Stability Report at the International Monetary Fund during the 2024 Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington DC. United States on April 16, 2024.

Anadolu | Anadolu | Getty Images

High corporate valuations could pose a significant risk to financial stability as market optimism becomes disconnected from fundamentals, the director of the IMF’s monetary and capital markets department said on Tuesday.

Financial markets have been in turmoil for much of this year, buoyed by falling inflation and hopes of impending interest rate cuts. But this “optimism” has pushed company valuations so high that they could become vulnerable to an economic shock, said Tobias Adrian.

“We’re concerned in some segments where valuations have become quite high,” Adrian told CNBC’s Karen Tso on Tuesday.

“Last year the technology sector led the way, but at this point we have seen valuations rise across the board. The question is always to what extent will we see a readjustment in the event of a negative shock to pricing,” he said.

Adrian, speaking on the sidelines of the IMF’s spring meeting in Washington, said credit markets were a particular area of concern.

“I would point to the credit markets, where spreads are very tight even though borrower fundamentals are deteriorating, at least in some segments,” he said.

“Even riskier borrowers can issue new debt, and at very affordable prices,” he added.

Real estate risks

The IMF’s funding concerns also extend to the property market and especially commercial property, which Adrian says has become “somewhat worrying”.

Medium and small lenders in particular could be vulnerable to commercial real estate shocks as the sector has come under pressure from the shift to remote working and online shopping, he said.

“There really is a connection between the exposure of some banks, particularly medium and smaller banks, to commercial real estate, which tends to be there as well [a] fragile financing basis. “Kind of a combination of risk exposure to commercial real estate and this fragile financing that could lead to some instability in some scenarios,” Adrian said.

The IMF released its global economic outlook on Tuesday, in which it slightly raised its global growth forecast and said the economy had proven “surprisingly resilient.”

It now expects global growth of 3.2% in 2024, but noted that downside risks remain, including from inflation and the increasingly uncertain trajectory of interest rates.

Federal Reserve Chairman Jerome Powell said on Tuesday that inflation in the US economy has not returned to target, raising the likelihood of a short-term interest rate cut.

“We see risks regarding ongoing inflation. Some of this has already made itself felt, but of course we could have further surprises,” said Adrian.

“We have this [cited] The risks are largely balanced worldwide. But in some countries there is a little more upside potential and in others there is a little more downside potential. So interest rate risk is certainly a key factor that we look at,” he added.

Source link

2024-04-17 09:12:46

www.cnbc.com