Bonnie and Clyde, Ma Barker, Baby Face Nelson and Willie Sutton robbed banks. When asked by a journalist why he did that, Sutton famously replied, “Because that’s where the money is.” While banks’ $3.1 trillion in cash and invested assets tempt criminals to steal from banks The insurance industry’s $10 trillion in assets may tempt fraudsters even more. And it does.

While banks’ annual losses from fraud are in the region of $2.7 billion, insurance fraud amounts to a staggering $308.6 billion annually. The FBI, which prosecutes major insurance fraud cases, confirms that the enormous size of the insurance industry “contributes significantly to the cost of insurance fraud by providing more opportunities and greater incentives to commit illegal activities.” And from the fraudster’s perspective, insurance fraud is a crime that doesn’t require a gun, a mask, or a getaway car. At a time of congressional hearings about how to reduce insurance costs for consumers, one solution is to combat insurance fraud. Insurers’ fraud-related losses are passed on to all policyholders. If insurance fraud were abolished, premiums would be 10 percent lower.

Insurance fraud is the second largest category of white-collar crime after tax evasion. Insurers’ massive losses due to fraud dwarf theft in other industries. The shrinkage (theft) rate in retail is 1.6 percent. The wholesaler/inventory shrinkage rate is estimated at 4 percent.

Insurance fraudsters may justify defrauding an insurance company by arguing that it is a victimless crime. In a recent survey on attitudes toward insurance fraud, nearly 9 percent of respondents justified insurance fraud as neither wrong nor criminal, believing that “insurance companies rip people off, so it’s fair” and “I pay them enough, it’s my money.” .” I’ll be back.” The survey found that a high percentage of respondents (28.6%) viewed insurance fraud as “not a real crime” (8.5%) or as a “business practice with no real victim” (20.1%). looked.

The many facets of insurance fraud

Insurance fraud comes in many shapes and sizes. It ranges from registering cars in a state other than the state in which you live because fees and insurance there can “save” hundreds of dollars, to a recently uncovered scheme that defrauded Medicare of $2 billion.

The main types of insurance fraud (in descending order of fraud level) include:

| Insurance fraud category | Description or example | Estimated annual fraud amount |

| Life insurance | Failure to report health status, obtaining life insurance on another person’s life and murdering that person, faking death | $74.7 billion |

| Medicaid and Medicare | Providing unnecessary services | $68.7 billion |

| Property and casualty insurance | Staged accidents, arson | $45.0 billion |

| Healthcare | Providers bill for services not provided | $36.3 billion |

| Premium avoidance | Misclassification of employees or inadequate payroll reporting | $35.1 billion |

| Workers compensation | The worker claimed he was injured at work, but that was not the case | $34.0 billion |

| disability | Claims to have a disability and lack mobility while training for a 10K race that is not wheelchair accessible | $7.4 billion |

| Car theft | Committed alone or operated by criminal gangs as a profit center | $7.4 billion |

| In total | $308.6 billion |

(Data source: The Impact of Insurance Fraud on the US Economy. Coalition Against Insurance Fraud. 2022. https://insurancefraud.org/wp-content/uploads/The-Impact-of-Insurance-Fraud-on-the-US – Economic report-2022-08/26/2022.pdf)

Disturbing generational trends

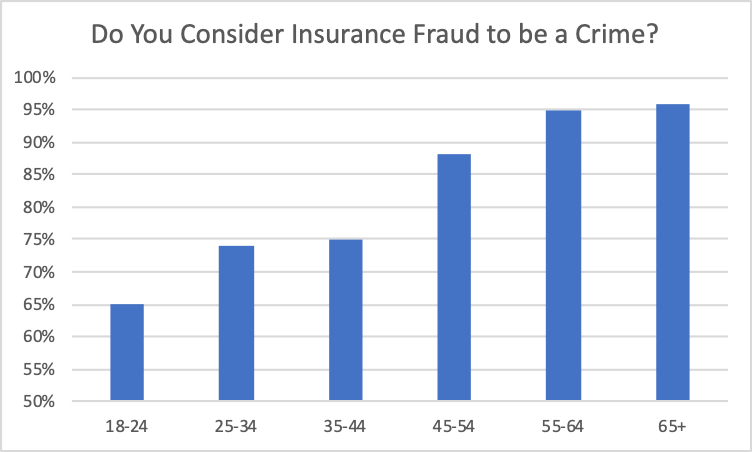

Whether or not someone considers insurance fraud a crime depends in part on their age. In the report with the results of the study “Who Me?” According to the study, respondents aged 45 and over are significantly more likely to view insurance fraud as a crime. Among the youngest respondents aged 18 to 24, it was almost 65 percent, and among those aged 65 and over it was 96 percent.

(Data source: Who me? Who commits insurance fraud and why? Coalition Against Insurance Fraud and Verisk. 2023. Used with permission. https://insurancefraud.org/wp-content/uploads/WHO_ME_STUDY_REPORT.pdf)

The “Who Me?” The survey also found that respondents under 45 reported significantly higher levels of dishonesty than those a generation older. It was found that those under 45 are much more likely to “Definitely…file a claim for a vehicle caused by a previous car accident,” a homeowner’s claim, or an insurance policy with damages from a prior event and would “I would definitely help a doctor bill an insurance company for treatment I did not receive.”

As the older generation ages, insurance companies fear they will increasingly be faced with respondents who say they have fewer scruples about committing insurance fraud

Tales from the dark side

Some of the most frightening examples of insurance fraud are grisly affairs that reveal the darkest side of humanity:

- John Gilbert Graham planted a time bomb on a plane his mother was traveling on to pay life insurance. The bomb exploded. Apart from Graham’s mother, all 43 other passengers and crew members were killed.

- Utah doctor Farid Fata administered chemotherapy to hundreds of women who did not have cancer. Fata submitted $34 million in fraudulent claims to Medicare and private insurance companies.

- Ali Elmezayen staged a freak car accident that killed his two autistic children and nearly drowned his wife. He collected a $260,000 insurance payout, but his crime was discovered. He was sentenced to 212 years in prison.

- A federal grand jury in Chicago has indicted 23 defendants for participating in a fraud scheme that defrauded 10 life insurers of $26 million. Fraudulent policy applications were made and the identity of the deceased was misrepresented.

There are thousands of other equally horrific insurance fraud stories. The annual Dirty Dozen Hall of Shame report details some of the most egregious and helps understand the lengths fraudsters will go to defraud insurance companies.

How is insurance fraud combated?

There are several organizations that fight insurance fraud. The insurance agency has a fraud investigation unit in 42 states. In other states, such as Colorado, insurance fraud investigations are the responsibility of the attorney general’s office. The Fraud Units are staffed by anti-fraud and criminal investigators who work with federal, state and local law enforcement agencies to prosecute insurance fraud. If multiple states are involved in the fraud or it is a major case, the FBI may prosecute the case. Insurance companies also have internal Special Investigation Units (SIUs).

New developments – artificial intelligence

Improvements in predictive modeling and the introduction of artificial intelligence (AI) have strengthened insurers’ ability to identify and ultimately investigate submitted claims that may be fraudulent. At the same time, AI is also being used as a weapon to penetrate insurers’ fraud detection systems. Techniques used include AI-generated fake photos of cars of a specific make and model that do not show real damage but are used to obtain compensation for damages. Some insurers no longer accept photos because they may be manipulated and instead rely on experts to personally inspect the allegedly damaged car. A nefarious life insurance fraud involves AI-powered manipulation of one’s voice so that a criminal third party can get past the insurer’s voice recognition technology and cause a policy to be delivered to a non-policyholder or non-beneficiary. It seems that criminals are keeping pace, if not advancing, with every additional layer of protection that insurers introduce.

Action required

Insurers need to step up their vaccination against the germ of insurance fraud. They should educate younger generations that insurance fraud is actually a crime, regardless of whether they think otherwise. In today’s populist political environment, large corporations, including insurers, are too often seen as responsible for eventual ills. As we have argued elsewhere, the combination of plaintiff law firms denigrating insurers and zealous consumer advocates denouncing insurers is giving the industry a black eye. In addition, the younger generation’s image of the insurance industry is tarnished by the fact that lawyers on advertising posters promise to hook them on the insurance company.

Insurers should also work with other parties fighting insurance fraud – state insurance department fraud units, local and federal law enforcement agencies, and organizations such as the Coalition Against Insurance Fraud and the National Insurance Crime Bureau. As insurance fraudsters exploit new technologies and younger generations with negative attitudes toward insurance become policyholders, the battle may become tougher, but it must be fought if combating insurance crime can ever result in lower insurance premiums.

subjects

Fraud

Interested in cheating?

Receive automatic notifications for this topic.

Source link

2024-02-12 15:27:12

www.insurancejournal.com