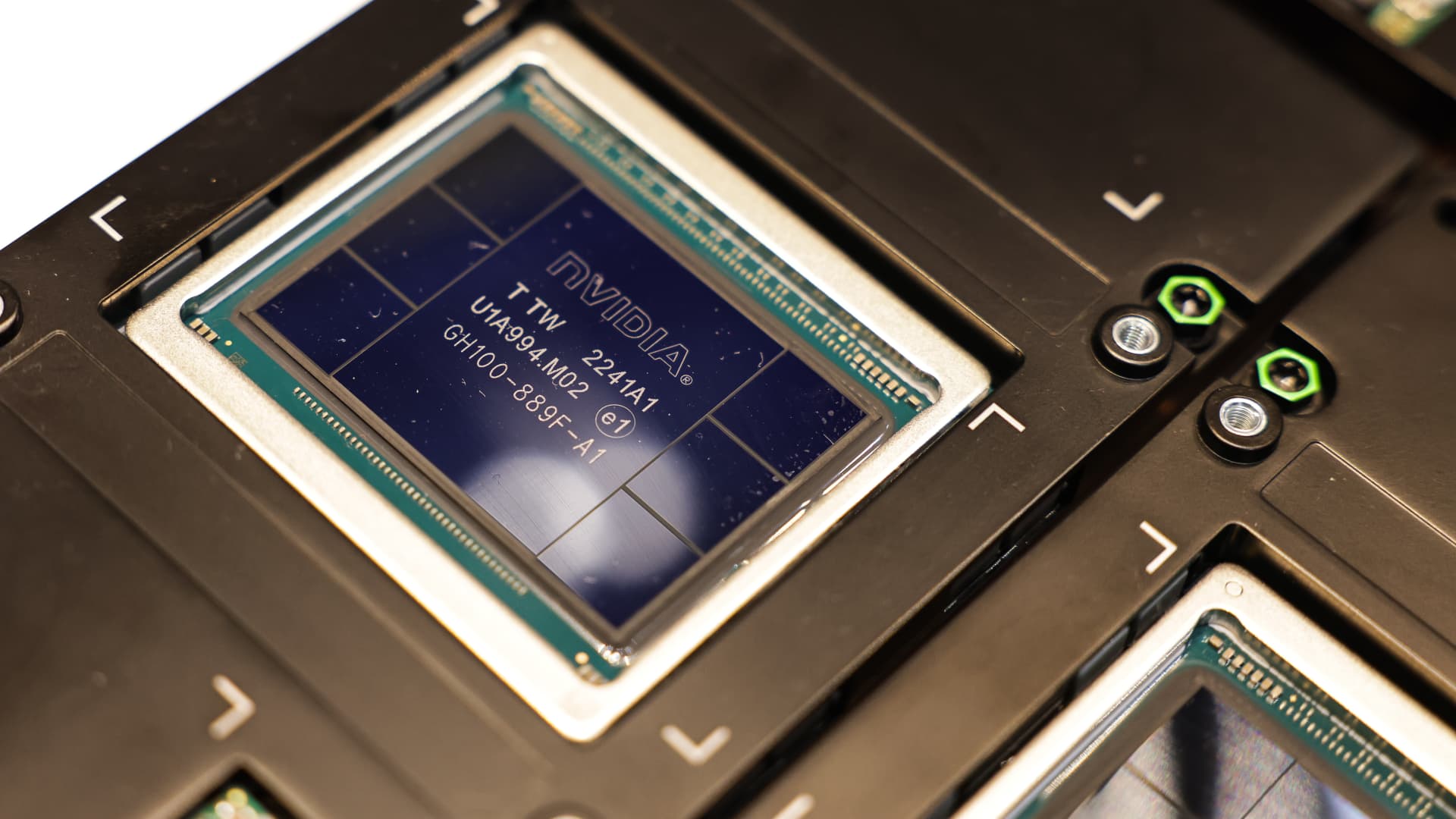

Nvidia According to VanEck CEO Jan van Eck, shares hit a new all-time high today and gains could still be in the early innings.

Van Eck, whose firm manages the largest U.S. semi-exchange-traded fund, points to a first-mover advantage in the race to make artificial intelligence chips that could boost the performance of stocks like Nvidia.

“It’s just that these companies have enormous competitive advantages, almost quasi-monopolies,” he told CNBC’s “ETF Edge” on Monday.

Nvidia is up 216% over the past year and up 41% since Jan. 1 (as of Wednesday).

“Who is competing with Nvidia for GPUs?” [graphics processing units]?”, asked he. “They have a lot of pricing power. They have AI.”

That’s Nvidia VanEck Semiconductor ETF‘s top holding company. The fund tracks 25 of the largest semiconductor companies, weighted by market capitalization. According to FactSet, Nvidia accounts for almost a quarter of the fund’s assets.

“[Nvidia’s] The lead is so big,” van Eck added. “The return on equity is enormous.”

He suggests that Nvidia’s more advanced capabilities could cushion the company’s current status as the most valuable semiconductor stock as more competitors move into the AI GPU space.

“They’re trying to expand their moat by now offering software services, and now they’re building a cloud solution,” van Eck said. “But who can really keep up with that?”

The VanEck Semiconductor ETF’s top holdings as of Wednesday are Nvidia, Taiwan Semiconductor And Broadcom. The ETF is up more than 12% this year.

Disclaimer

Source link

2024-02-08 00:00:02

www.cnbc.com