Robert A. Iger has insisted for months that his Disney turnaround plan is working. But hard evidence was lacking and investors were reluctant to buy in, as shown by the company’s underperforming share price and several proxy campaigns by activists for board seats.

On Wednesday, Mr. Iger delivered financial evidence — along with a flurry of announcements about future entertainment offerings, including a sequel to “Moana,” the release of Taylor Swift’s concert film on Disney+, a partnership with Epic Games to create a connected Disney universe, Fortnite and the Launching a flagship streaming service from ESPN in 2025 that will include the sports giant’s core programming.

“Just a year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation,” Mr. Iger said in a statement. “Our strong performance in the last quarter shows that we have turned the corner.”

Mr. Iger said Disney’s multi-year partnership with Epic Games is the company’s “largest entry into the world of gaming ever” and offers significant growth and expansion opportunities. As part of the deal, Disney acquired a $1.5 billion stake in Epic.

Disney shares rose 7 percent to about $106 in after-hours trading.

Disney’s earnings per share totaled $1.22 in the most recent quarter, 23 percent more than Wall Street expected. Breaking with its long-standing practice of not providing earnings guidance, Disney said full-fiscal earnings per share would rise at least 20 percent compared to 2023, driven in part by record highs in sales, profits and operating margins on the subject be Parks.

Mr. Iger, Disney’s CEO, announced a $3 billion stock repurchase plan, the company’s first since 2018, and a cash dividend of 45 cents per share, a 50 percent increase over the previous dividend issued in was paid out in January.

Disney’s streaming service was expected to lose $400 million this quarter. Instead, losses were reduced to $138 million as Mr. Iger reiterated that streaming would be profitable by the fall. The number of Disney+ subscribers fell by 1.3 million in the quarter, which was expected given a monthly price increase. But Disney said the service is on track to add at least 5.5 million subscribers in the current quarter.

Some investors were concerned about Disney’s ability to generate free cash flow, a closely watched indicator of financial health, at a time when its television business has been undercut by streaming services. However, Disney said it is on track to generate $8 billion in free cash flow this year, approaching pre-pandemic levels.

The results come amid intense pressure on Disney from activist investors, including Trian Fund Management, which is seeking multiple board seats to improve streaming profitability and a clear plan for CEO succession, which has plagued Disney. Trian, founded by Nelson Peltz, cites Disney’s declining stock price as motivation.

Disney sees a revenge story: Mr. Peltz is aligned with Ike Perlmutter, who was ousted from an executive post at Disney, and Jay Rasulo, a former Disney executive who was passed over as chief executive in 2015 and resigned. Disney has asked shareholders to reject Trian and another activist investor, Blackwells Capital, arguing that giving them board seats would slow the company’s turnaround efforts. (Mr. Peltz led an unsuccessful campaign to reorganize Disney last year.)

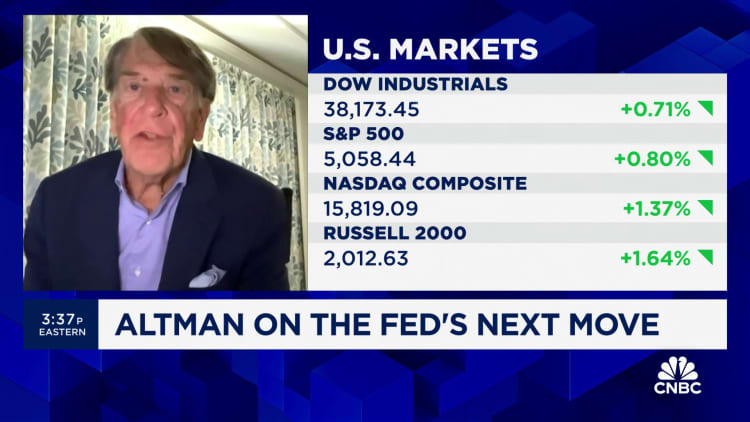

“The last thing we need right now is to have our time and energy diverted by one or more activists who, frankly, have a completely different agenda and do not understand our company, its assets or even the essence of it Disney brand,” Mr. Iger said on CNBC on Wednesday.

Trian brushed aside Disney’s strong quarterly results and many announcements. “It’s déjà vu all over again,” a Trian spokesperson said, apparently referring to February 2023, when Disney unveiled its turnaround efforts. “We saw this movie last year and we didn’t like the ending.”

Mr. Iger used part of Disney’s quarterly conference call with analysts to highlight progress in strengthening ESPN in an uncertain future.

Disney will launch a flagship ESPN streaming service in 2025, “probably in the fall, maybe as early as the end of August,” Mr. Iger said. The service will include most of the programming currently seen on the primary ESPN cable channel. It will also offer sports betting, extensive statistics, fantasy sports and e-commerce, and have “robust” personalization features. (The flagship ESPN service will be separate from ESPN+, a streaming app that offers more niche programming.)

Additionally, Disney, Fox and Warner Bros. Discovery announced Tuesday that they would join forces and sell access to all of the sports they televise (across 14 cable channels) through another new streaming service. It will be available in the fall. Further details, such as the price or who would operate the service, are not yet known.

Disney’s theme parks and consumer products division posted a profit of $3.1 billion, up 8 percent from a year earlier. Sales rose 4 percent to $6.3 billion. For the first time ever, all of Disney’s overseas theme parks were profitable, including the long-troubled Hong Kong Disneyland.

Lauren Hirsch contributed reporting.

Source link

2024-02-07 23:51:00

www.nytimes.com