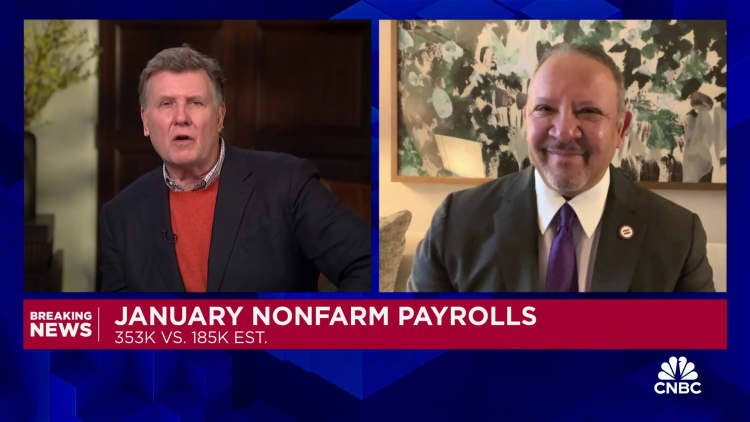

Job growth posted a surprisingly strong increase in January, once again showing that the U.S. labor market is solid and poised to support overall economic growth.

Nonfarm payrolls rose by 353,000 this month, much better than the Dow Jones estimate of 185,000, the Labor Department’s Bureau of Labor Statistics reported Friday. The unemployment rate remained at 3.7%, compared to the estimate of 3.8%.

Wage growth also showed strong growth, with average hourly wages rising 0.6%, twice the monthly estimate. Year-on-year, wages rose by 4.5%, well above the forecast of 4.1%. The wage increases came against the backdrop of a decline in average hours worked to 34.1, or 0.2 hours fewer for the month.

Job growth was widespread this month, led by professional and business services at 74,000. Other major contributors included healthcare (70,000), retail (45,000), government (36,000), welfare (30,000) and manufacturing (23,000).

“This is just confirmation that the labor market is heading into 2024 on solid footing,” said Daniel Zhao, senior economist at Glassdoor. “The fact that job growth has been so widespread across sectors is a healthy sign. Coming into the report today, we were concerned about how concentrated jobs actually were in just three sectors – healthcare, education and government. While it’s great to see these sectors, “while they would drive job growth, there was no guarantee that this would be enough to support a healthcare job market.”

The report also pointed out that employment gains in December were much better than originally reported. The month saw an increase of 333,000, an upward revision of 117,000 from the original estimate. The number for November was also revised upwards to 182,000, 9,000 more than the last estimate.

DON’T MISS: The ultimate guide to acing your interview and getting your dream job

While the report demonstrates the resilience of the U.S. economy, it could also raise questions about how quickly the Federal Reserve will be able to cut interest rates.

“Make no mistake, this was a disastrous jobs report and will justify the Fed’s recent stance that has effectively ruled out a rate cut in March,” said George Mateyo, chief investment officer at Key Private Bank. “In addition, strong employment gains coupled with faster-than-expected wage increases could suggest a further delay in rate cuts for 2024 and should cause some market participants to recalibrate their thinking.”

Futures markets shifted following the report, with traders now pricing in a more than 80% chance that the Fed won’t cut interest rates at its March meeting, according to CME Group.

Following the report, stocks were mixed. The Dow Jones Industrial Average fell at the open, but the S&P 500 and Nasdaq were both positive. Government bond yields rose sharply.

As employment counts begin in January, economists and policymakers are watching employment numbers closely to determine which direction the overall economy will move. Some recent high-profile layoffs have raised questions about the sustainability of this strong hiring trend.

A broader measure of unemployment that includes discouraged workers and those who hold part-time jobs for economic reasons rose slightly to 7.2%. The household survey, which measures the number of people actually employed, differed significantly from the company survey and showed a decrease of 31,000 compared to the previous month. The labor force participation rate remained unchanged at 62.5%.

A potentially important caveat in the report could be the discrepancy between average hourly wages and hours worked. Retail trade recorded a new all-time low of 29.1 hours in data from March 2006.

“This suggests that, for now, employers have chosen to reduce working hours rather than resort to layoffs,” the Conference Board said in a report analysis.

Broader layoff figures, such as the Labor Department’s weekly report on initial jobless claims, show that companies are reluctant to part with their workers in such a tight labor market.

Gross domestic product growth also fell short of expectations.

In the fourth quarter, GDP rose sharply by 3.3% on an annual basis, capping a year in which the economy defied widespread recession forecasts. The growth in 2023 came even as the Fed continued to raise interest rates in its effort to reduce inflation.

The Atlanta Fed’s GDPNow tracker suggests a 4.2% gain in the first quarter of 2024, although there is limited data on where things are headed in the first three months of the year.

Economic, employment and inflation dynamics paint a complicated picture as the Fed attempts to ease monetary policy. Earlier this week, the Fed again held short-term borrowing costs steady and hinted that rate cuts could be imminent, but only if inflation shows further signs of cooling.

Chairman Jerome Powell noted in his post-meeting press conference that the central bank does not have a “growth mandate” and said central bankers remain concerned about the impact of high inflation on consumers, particularly those at the lower end of the income scale.

Aside from wage numbers, recent data shows that inflation is moving in the right direction.

Core inflation, measured by consumer spending prices, was just 2.9% year-on-year in December, while six- and three-month indicators both suggested the Fed was at or around its 2% target.

Still, the Atlanta Fed’s “sticky” inflation, which focuses on items such as housing, medical care and insurance costs, was 4.6% on a 12-month basis in December.

Don’t miss these stories from CNBC PRO:

Source link

2024-02-02 16:33:33

www.cnbc.com