A trader reacts as the Fed’s interest rate announcement is displayed on a screen on the floor of the New York Stock Exchange (NYSE) in New York City, United States, January 31, 2024.

Brendan McDermid | Reuters

According to Cole Smead, CEO of Smead Capital Management, the U.S. stock market is in a “very dangerous” position as persistently high employment and wage growth suggest that the Federal Reserve’s interest rate hikes have not had the desired effect.

Nonfarm payrolls rose by 353,000 in January, new data showed last week, far exceeding the Dow Jones estimate of 185,000, while average hourly wages rose 0.6% on a monthly basis, twice as much like the consensus forecasts. Unemployment remained stable at a historically low level of 3.7%.

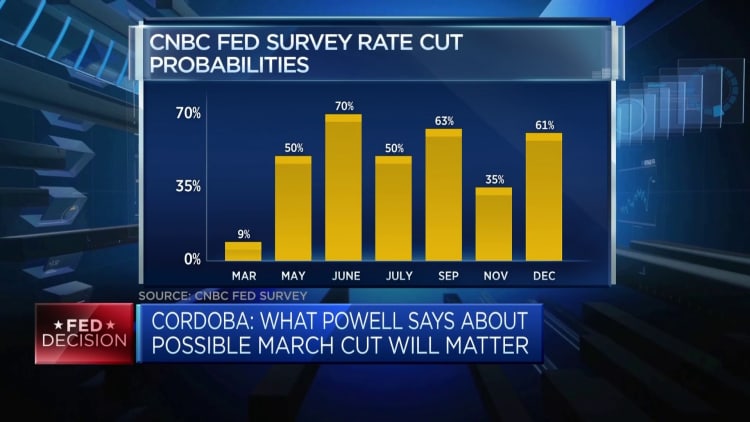

The numbers came after Fed Chairman Jerome Powell said the central bank was unlikely to cut interest rates in March, as some market participants had expected.

Smead, who has so far correctly predicted the U.S. consumer’s resilience in the face of tighter monetary policy, told CNBC’s “Squawk Box Europe” on Monday that “the real risk all along was how strong the economy was” despite 500 basis points of interest rate increases. One basis point is equal to 0.01%.

“We know the Fed raised interest rates, we know this led to a bank run last spring, and we know this hurt the bond market. I think the real question may be, ‘Do we know that the CPI decline was actually caused by this short selling?’ ‘What are the policy tools they’re using?'” Smead said.

“Wage growth continues to be very strong. The Fed has not impacted wage growth, which currently continues to outpace inflation, and I view wage growth as a really good picture of future inflation pressures.”

Inflation has slowed significantly from the pandemic-era peak of 9.1% in June 2022, but the U.S. consumer price index rose 0.3% in December from the previous month, reaching an annual rate of 3.4%, also above consensus estimates and higher than the Fed’s 2% target.

Smead argued that the decline in the consumer price index should be attributed to “luck,” as falling energy prices and other factors outside the central bank’s control contributed, rather than the Fed’s aggressive cycle of monetary tightening.

If the labor market, consumer sentiment and household balance sheets remain stable, the Fed may need to keep interest rates higher for longer. This would ultimately mean that more and more listed companies would have to refinance themselves at a much higher level than before and the stock market would therefore possibly not benefit from the economic strength.

Smead highlighted a period between 1964 and 1981 when the economy was “generally strong” but the stock market did not benefit proportionately due to persistent inflationary pressures and restrictive monetary conditions, suggesting that markets were entering a similar phase could.

The three major Wall Street averages closed on Friday despite Powell’s warning of interest rate cuts and record profits from US tech giants such as Meta provided further optimism.

“The better question might be, given the strength of the economy, why is the stock market so valued and the Fed is being pigeonholed as having to keep these rates high? This is a very dangerous thing for stocks,” Smead warned.

“And to continue that, the economic benefit that we see in the economy has very little to do with the stock market, it doesn’t benefit the stock market. What did the stock market do last year? Valuations have increased.” Did it have a lot to do with the earnings growth associated with the economy? Not at all.”

The need to cut interest rates becomes “less urgent”

However, some strategists point out that the upward trend in recent data means that the Fed’s efforts to create a “soft landing” for the economy are bearing fruit and that a recession appears to be no longer in sight, which could lead to restrictions Disadvantage for the broader market.

Richard Flynn, managing director of Charles Schwab UK, noted on Friday that until recently such a good jobs report “would have rung alarm bells in the market,” but that no longer appears to be the case.

“And while lower interest rates would certainly be welcome, it is becoming increasingly clear that markets and the economy are coping well with the high interest rate environment, so investors may feel that the need for monetary easing is less urgent,” he said in a statement Note.

“[Friday’s] The numbers could be another factor that delays the Fed’s first rate cut closer to summer, but if the economy stays on its comfortable path that might not be a bad thing.”

Daniel Casali, chief investment strategist at Evelyn Partners, shared this by saying that the bottom line is that investors are “somewhat confident that central banks can balance growth and inflation.”

“This favorable macroeconomic backdrop is relatively positive for stocks,” he wrote in a note.

Source link

2024-02-05 13:54:54

www.cnbc.com