The Swiss national flag hangs at the Bundeshaus, the Swiss parliament building, in Bern, Switzerland, on Thursday, December 13, 2018. The Swiss National Bank lowered its inflation forecast and showed no inclination to deviate from its crisis-era settings due to the strength of the franc and growing global risks. Photographer: Stefan Wermuth/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

The Swiss National Bank surprised the market on Thursday with a decision to cut its key interest rate by 0.25 percentage points to 1.5% and said national inflation was likely to remain below 2% for the foreseeable future.

Economists polled by Reuters had expected the Swiss central bank to keep interest rates at 1.75%.

“Inflation has been below 2% again for a few months and is therefore in the range that the SNB equates with price stability. According to the new forecast, inflation is likely to remain in this range in the next few years,” the bank said. Swiss inflation fell further in February, reaching 1.2%.

The SNB also reduced its annual inflation forecasts. The bank now expects average inflation to reach 1.4% in 2024, below its estimate of 1.9% in December, and 1.2% in 2025, a reduction from the previous estimate corresponds to 1.6%. In its first forecast for 2026, average inflation for that period is estimated at 1.1%.

After the announcement, analysts at Capital Economics said they expect two more rate cuts from the SNB later this year, “with the bank sounding more dovish and inflation likely to be below its forecasts.”

“We expect inflation to be even lower than the new SNB forecasts suggest, remaining around current levels of 1.2% before falling below 1.0% next year . Accordingly, we predict that the SNB will cut interest rates at the meetings in September and December. “We will cut the key interest rate to 1%, where we expect it to remain in 2025 and 2026,” Capital Economics analysts said in a message.

The September meeting is likely to be the last under the leadership of SNB chief Thomas Jordan, who will step down at the end of the month after 12 years at the helm.

The SNB said Swiss economic growth is “expected to remain moderate in the coming quarters,” with GDP expected to grow by about 1% this year.

“Our forecast for Switzerland, as well as for the global economy, is subject to considerable uncertainty. The main risk is weaker economic activity abroad. The momentum on the mortgage and real estate markets has noticeably slowed in recent quarters,” said the SNB. “However, the vulnerabilities in these markets remain.”

At the macroeconomic level, the SNB forecast “moderate” global economic growth in the coming quarters, as well as a likely decline in inflation, partly due to restrictive monetary policies. Nevertheless, “significant risks” and geopolitical tensions were acknowledged that could cloud the international economic horizon.

In a television interview with CNBC’s Silvia Amaro, Jordan said the bank’s improved inflation forecast gave it room to cut rates, but did not want to rely on the inevitability of three rate cuts this year.

“We will see in June whether the situation changes, whether inflation pressures continue to ease, and then we will take a new decision in June,” he said, acknowledging that the bank remained ready to step in “if necessary.” to intervene in the foreign exchange market “to defend the Swiss franc. High interest rates typically support currencies and weaken the relative value of other coins against them.

“We have been very clear that we remain…available to intervene in the foreign exchange market if necessary. “So we can use this tool to ensure that monetary conditions remain appropriate,” noted Jordan.

He did not comment on whether other central banks would follow the SNB’s pioneering lead and ease their monetary policy, but did not express concerns about the possible impact of their measures on the Swiss currency.

“We will benefit from a situation where we have price stability around the world. Of course that could have an impact on interest rate differentials, but I think that a situation in which price stability is restored everywhere is something positive for our global economy and therefore also for Switzerland,” he said.

Blink first

Switzerland is the first advanced economy to cut interest rates after a prolonged period of high inflationary pressures, exacerbated by the impact of the Covid-19 pandemic on global trade and Russia’s war in Ukraine. Switzerland was also hit by turmoil in the banking sector last year when the government stepped in to facilitate UBS’s takeover of fallen rival Credit Suisse.

Jordan stressed the importance of liquidity for the Swiss banking sector to CNBC on Thursday.

“A key message from us is always that they need to prepare their collateral so that that collateral … in the event that they need additional liquidity,” he said.

Asked whether Swiss lenders are doing enough in this direction, Jordan said there are “very good discussions in Switzerland at the moment” between banks and the SNB.

“The situation in March last year and in the United States also made it clear to smaller banks that liquidity problems could be a problem,” he said. “I think we are well on our way to ensuring that there is sufficient security in the event of an emergency … but it is very important that we continue on this path.”

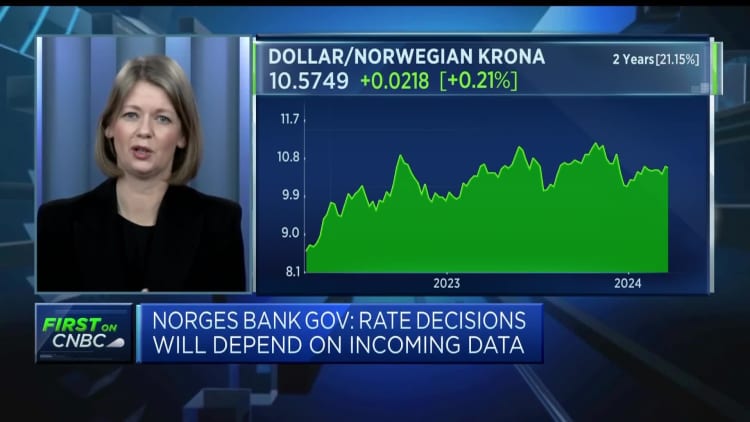

The Swiss National Bank’s rate announcement came just before Norway’s central bank refused to bat an eyelid and kept rates steady at 4.5%.

“The interest rate path that we present today suggests a rate cut in the fall, most likely in September,” Ida Wolden Bache, governor of Norges Bank, said at a news conference on Thursday, according to Reuters.

Later in the meeting, the Bank of England also left its interest rates unchanged at 5.25%.

This came after the US Federal Reserve on Wednesday kept interest rates stable following its March meeting and reiterated its expectations for three rate cuts in 2024. The European Central Bank also left its policy unchanged, with officials signaling that policymakers will consider cutting interest rates in June – but pointing out that the decision remains heavily data-dependent.

Source link

2024-03-21 13:14:32

www.cnbc.com