Who wouldn’t secure an income tax refund if they had one?

It turns out that there are around 940,000 people – because they didn’t file a tax return for the 2020 tax year, even though they may get money back for this year. However, there is still almost a month left to file and collect refunds. The Internal Revenue Service estimates that the typical refund for people in this group is more than $900.

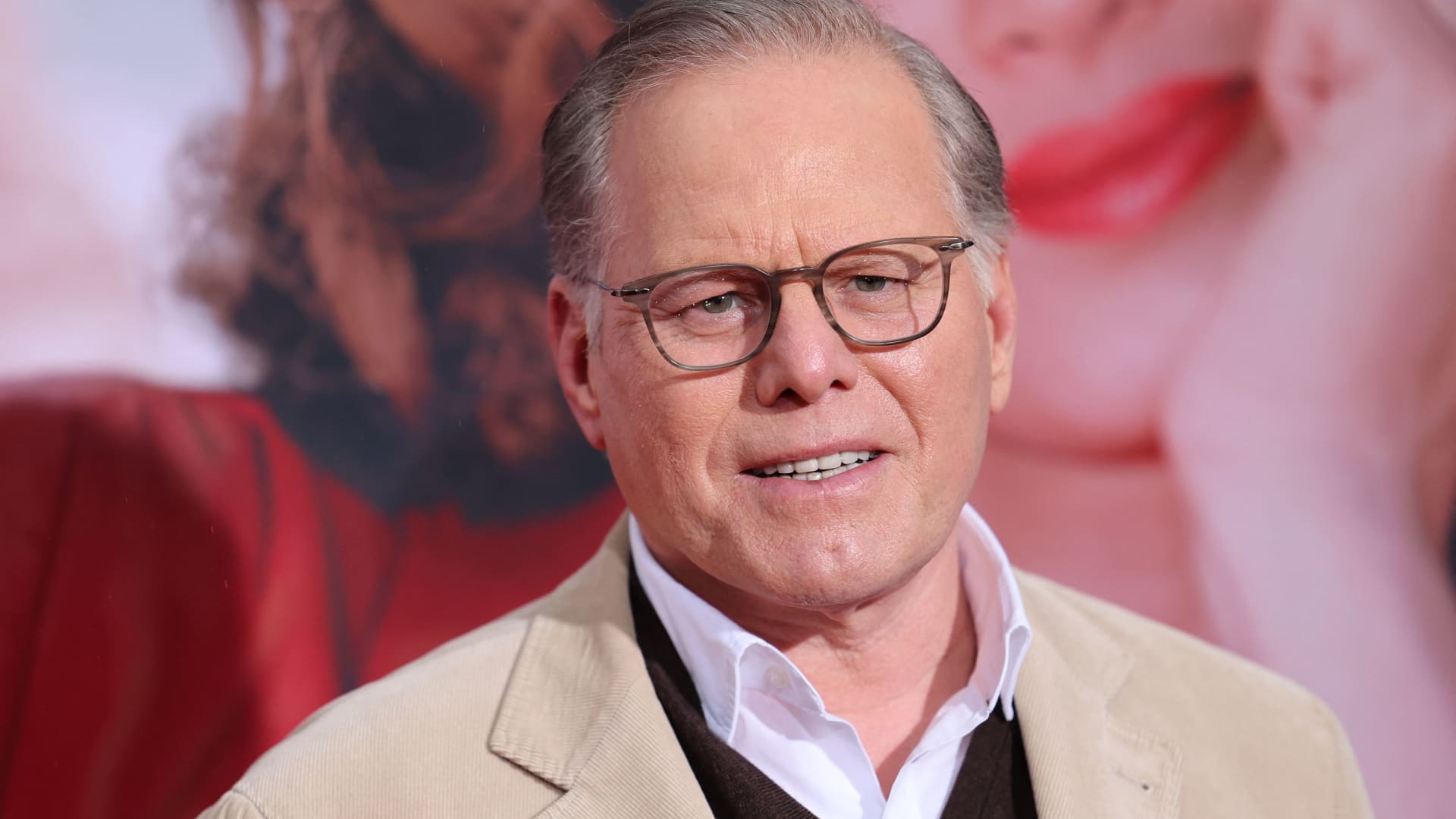

“There is still money on the table for hundreds of thousands of people who did not file their 2020 taxes,” IRS Commissioner Daniel Werfel said in a statement. The deadline for most people to file a tax return and collect the refunds, which total about $1 billion, is May 17.

Possible refunds range from a typical amount of $761 in Idaho to more than $1,000 in New York and Pennsylvania, the IRS said. (Actual amounts vary depending on the applicant’s tax situation.)

Some people may have simply forgotten to file a 2020 tax return due to “extremely unusual situations” during the pandemic, Mr. Werfel said. Still, said Eric Smith, an IRS spokesman, the number of taxpayers who may be due a refund this year for 2020 is not at record levels. Last year, when the three-year deadline for filing and collecting unclaimed refunds from the 2019 tax year applied – refunds that were originally due in the depths of the pandemic in 2020 – nearly 1.5 million people were potentially eligible for refunds in the Typically around $800.

The IRS was also affected by the pandemic. The agency has had difficulty processing paper tax returns and correspondence, even though the IRS has “virtually eliminated our backlog of unprocessed paper returns” for individual returns, Mr. Smith said.

If you don’t file a 2020 tax return by the deadline, you’ll lose the refund – and the Treasury will keep it. “Why leave money on the table?” said Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals.

Generally, taxpayers have three years to file a tax return and claim refunds. (There is no penalty for failure to file if you get any money back.) Tax returns for 2020 were due in 2021, but the filing deadline for this year was pushed back from the usual mid-April date to May 17 due to the pandemic. As a result, the IRS has also extended the three-year deadline for filing these tax returns by one month.

Some unclaimed refunds may be owed to part-time workers and others who did not earn enough money to meet the requirements for filing a tax return. (The filing threshold in 2020 was $12,400 for single filers and $24,800 for couples filing jointly; higher thresholds applied for those age 65 and older.)

Potential refunds could be higher than IRS estimates due to the impact of tax credits and pandemic stimulus payments in 2020. “The reality is that these are conservative estimates,” Mr. Smith said.

Some people may be eligible for refund credits if they didn’t receive their pandemic stimulus checks – also known as economic impact payments – in 2020. Most eligible people have received their payments or have already claimed them as a tax credit, according to the IRS. However, if they qualify and didn’t receive the payments, they can file a tax return to get the money as a credit – even if they had little or no income. The credit is “refundable,” meaning you can get the money back even if you don’t owe any taxes.

Additionally, many low- and middle-income workers may be eligible for the Earned Income Tax Credit, which is also refundable. The earned income tax credit depends on income and family size. In 2020, the credit value was up to $6,660 (for people with incomes up to $50,594 and three or more children).

“That’s a significant amount of money for working families,” Mr. O’Saben said.

Even filers without children are eligible for the credit if their income meets the requirements, said Andy Phillips, director of H&R Block’s Tax Institute. In 2020, a person without children earning up to $15,820 was potentially eligible.

People who have missed filing a tax return one year have often missed other years as well, said Cynthia Leachmoore, president of the National Association of Enrolled Agents, whose members are licensed tax professionals. People may initially fail to apply simply because they procrastinated or perhaps because they owed money, and then have difficulty getting back on track.

“They think it’s insurmountable,” she said. “It will be difficult to break the cycle.”

If you haven’t filed a tax return for 2021 or 2022, the IRS may withhold your 2020 refund until you do so. Additionally, your refund may be applied toward any taxes you still owe or that you are using to offset unpaid child support or other past-due federal debts, such as student loans.

Keep in mind that 2020 tax returns must be filed on paper, whether you do it yourself or hire a paid preparer. The IRS accepts electronically filed tax returns for the current tax season and two years prior, Mr. Smith said. Tax forms for previous years can be found online at IRS.gov or you can prepare your tax return using do-it-yourself software. However, you must print the 2020 tax return and mail it to the IRS

Ms. Leachmoore recommended sending the return via certified mail and including a return receipt so you have proof that you met the May 17 deadline and that the IRS received your return.

There are some exceptions to the extended registration deadline in May, Mr. Smith said, such as military service in a combat zone or a “financial disability” that prevents you from managing your money because of a physical or mental impairment.

But generally, he said, it’s best to file the refund by May 17 so you can claim your refund. “The sooner you apply,” he said, “the sooner you will receive your money.”

Here are some questions and answers about late tax returns:

What happens if I don’t have the tax documents I need to file a 2020 tax return?

You can ask your employer for W-2 pay stubs, companies for 1099 forms if you worked for them as a contractor, and your bank for interest statements. If you are unable to obtain the documents this way, you can use the IRS to order a free “Payroll and Income Statement,” which contains information from various documents the IRS has received about you, including W-2 pay stubs and 1099s. forms. Online “Get Transcript” tool. With the deadline fast approaching, “start the legwork now,” Mr. O’Saben said.

When can I expect my refund after I file my 2020 tax return?

Filers shouldn’t expect quick refunds because paper returns typically take longer to process, tax experts say. “It won’t take 21 days like e-filing,” said April Walker, senior manager of tax practice and ethics at the American Institute of Certified Public Accountants.

The IRS’s Mr. Smith said if you file a “complete and accurate” 2020 paper tax return, the refund should be issued approximately six to eight weeks after the date the tax return was received.

You cannot track your 2020 refund using the IRS “Where’s My Refund?” feature. Mr Smith said this service could only be used for the current tax season and two years before that. However, you can create an IRS account, which can be helpful in tracking older refunds, he said.

What happens if I missed the April 15 deadline to file my 2023 tax return?

“It is prudent to apply as soon as possible,” Mr Smith said. If you are entitled to a refund, you will not be able to receive it until you submit a claim. And if you owe taxes, minimize the penalties and interest incurred. (You can apply for a waiver of penalties if you have filed on time in the past.)

Source link

2024-04-19 13:00:29

www.nytimes.com