A new ETF is trying to make gains in the municipal funds space.

Joanna Gallegos of BondBloxx is behind the IR+M Tax-Aware Short Duration ETF (TAXX), which launched less than a month ago.

“When you think about municipal bond portfolios, you really want people to think beyond that and look at the relative value of after-tax income,” the company’s co-founder and COO told CNBC’s “ETF Edge” on Monday.

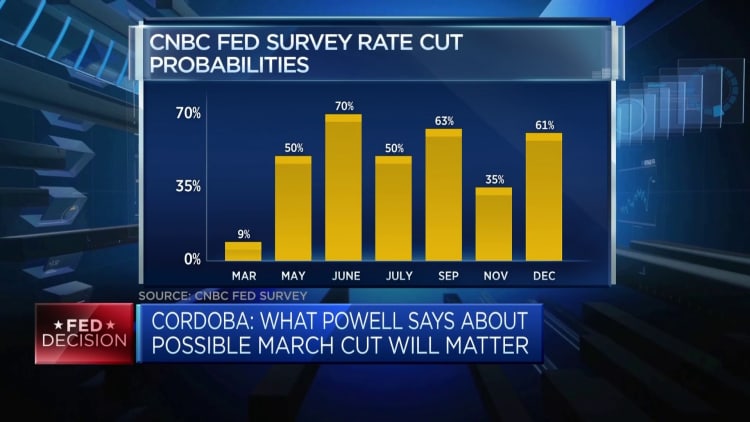

Gallegos sees actively managed municipal exchange-traded funds as an income-generating opportunity in a high-yield environment. It expects healthy returns even if the Federal Reserve begins cutting interest rates this year.

According to BondBloxx’s website, nearly 62% of TAXX’s holdings are municipal bonds. The top five local holdings by state as of Thursday were Illinois, Pennsylvania, New Jersey, New York and Alabama.

The ETF also includes exposure to corporate bonds and securitized bonds. The company says the fund’s blended bond approach offers a “greater opportunity” to increase total after-tax returns. FactSet describes the fund as “tax efficient” – combining strong after-tax income opportunities with capital preservation through both municipal and taxable short-term fixed income securities.

“Right now the tax equivalent return on the portfolio is just under 6%. If you look at it, it’s about 5.88,” Gallegos said. “It’s just the year to think about taxes.”

As of Friday, TAXX is down 0.2% since its March 14 start date.

Disclaimer

Don’t miss these stories from CNBC PRO:

Source link

2024-04-06 18:53:58

www.cnbc.com