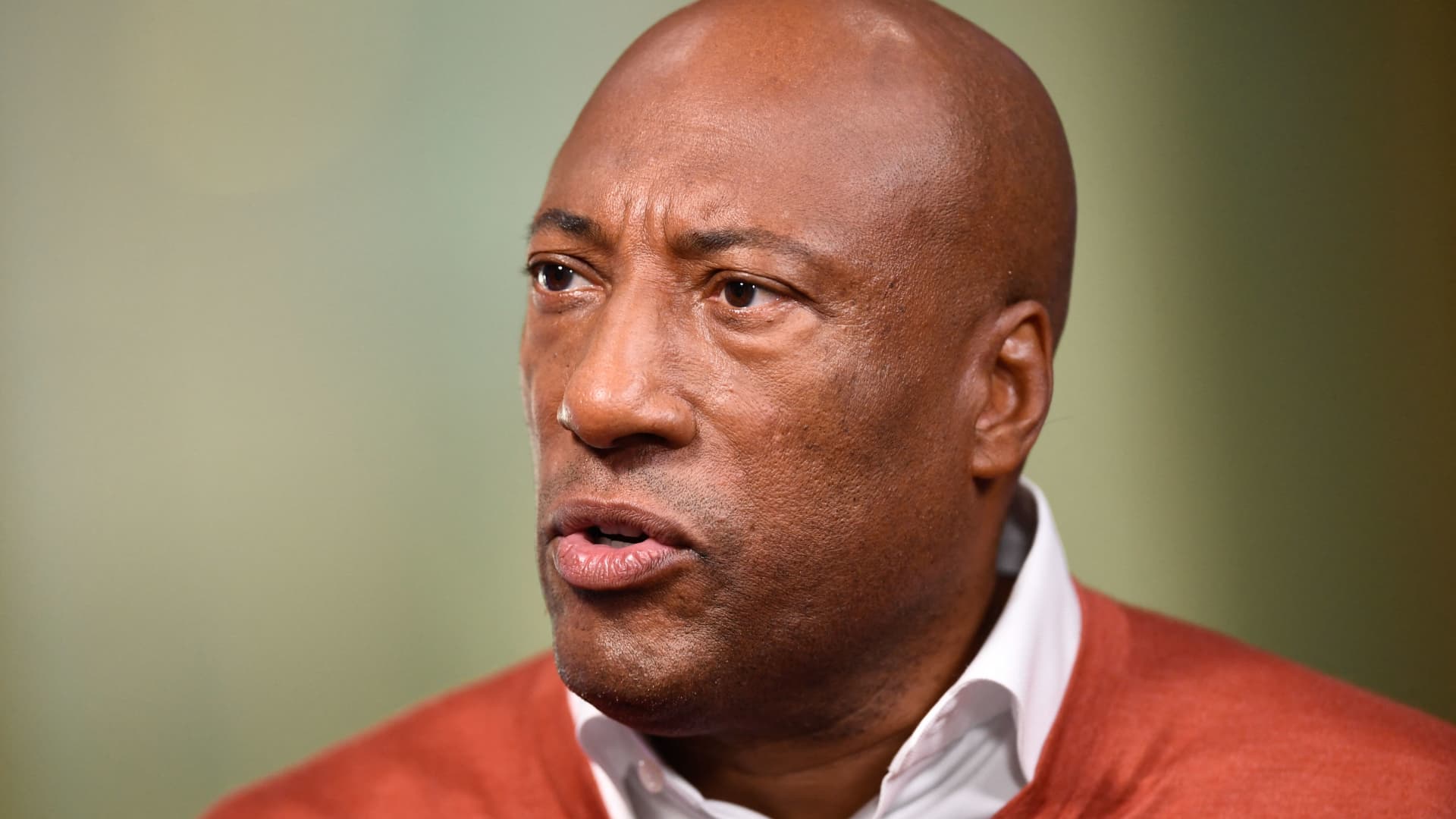

Byron Allen, Founder, Chairman and CEO of Allen Media Group, speaks during the Milken Institute Global Conference on May 2, 2022 in Beverly Hills, California.

Patrick T. Fallon | AFP | Getty Images

Byron Allen, the media mogul, is offering $14 billion for it Paramount Globaltold CNBC on Wednesday that he has the money to finance a deal, despite skepticism over his deal completion.

“We have more than enough capital available. The real challenge is the certainty that we will get a deal,” Allen said.

“This deal lives or dies [Federal Communications Commission],” he added.

Allen, the founder and CEO of a media conglomerate that owns dozens of television networks across the U.S., offered $30 billion for all of Paramount’s outstanding shares, including debt and equity.

Allen Media Group said in a statement that the offer was “the best solution for all Paramount Global shareholders and the offer should be taken seriously and pursued.”

Allen has a long history of making bids for major media stocks. But bidding does not mean buying.

Its recent media takeover bids have not translated into sales. The Wall Street Journal reported Wednesday that Allen offered $18.5 billion for Paramount last year and was rejected.

Allen told CNBC he has not received a response from Paramount to his latest offer.

Shari Redstone, who controls Paramount through her company National Amusements, has been open in recent months to deals to either merge or sell the company, which is home to brands such as CBS, Showtime, Nickelodeon and the eponymous film studio.

CNBC reported last week that David Ellison’s Skydance Media and his backers were exploring a deal to take Paramount Pictures or the entire media company private.

In December, CNBC also reported that Paramount had begun preliminary discussions with Paramount Warner Bros. Discovery bringing the two media giants together in a deal that could have overcome regulatory hurdles.

Allen’s takeover bid for Paramount is the most ambitious deal the media mogul has attempted to complete to date. Here are some of his recent deal attempts:

- In December, Allen renewed an attempt to buy Paramount-owned Black Entertainment Television and VH1 for a combined $3.5 billion.

- In November, Bloomberg reported that it was considering a bid to buy TV stations EW Scripps.

- In September, Allen made an offer to buy ABC and several other networks Disney for $10 billion after Disney CEO Bob Iger opened the door to selling the company’s linear TV assets.

- In 2022, he explored an offer to purchase the Washington Commanders of the National Football League.

- In March 2020, he offered $8.5 billion to buy the television station owner label.

Allen told CNBC by phone Wednesday that he lost several deals because the owners changed course to want to sell. He highlighted his 2018 acquisition of The Weather Channel for a reported $300 million and broadly defended his track record by invoking Baseball Hall of Famer Babe Ruth.

“Let’s talk about Babe Ruth. Is he considered one of the greatest baseball players of all time? And he struck out half the time,” Allen said. In fact, Ruth struck out 1,300 times in 8,399 at-bats – a 15% strikeout rate.

Allen’s offerings for linear TV assets come at a time when the media landscape is shifting from traditional television to streaming. Almost all major media companies have launched services to compete with the streaming giant Netflix.

Paramount reported in its third-quarter earnings report that its streaming platform Paramount+ grew subscribers to 63 million. However, Paramount’s direct-to-consumer products haven’t been able to turn a profit like Netflix. The division reported an adjusted loss of $238 million for the third quarter.

Paramount will report its fourth quarter results on February 28th.

Allen told CNBC he wants to buy Paramount for its linear networks, which he said is the most difficult part of the company.

“These are still great companies if you know how to manage them properly,” Allen said.

Shares of Paramount rose nearly 7% on Wednesday and have risen more than 35% in the past three months as deal talks grew. However, the stock is more than 40% below its 52-week high of $25.93 per share, reached in February 2023.

—CNBC’s Alex Sherman and Julia Boorstin contributed to this report.

Don’t miss these stories from CNBC PRO:

Source link

2024-01-31 21:38:13

www.cnbc.com