BEIJING – Chinese smartphone company Xiaomi believes it has identified a consumer niche that will pay off in a highly competitive market for its upcoming electric car.

“We believe it is a good starting point for us in the premium segment because we already have 20 million smartphone-based premium users in China,” Xiaomi Group President Weibing Lu told CNBC ahead of the International unveiling of the car at the Mobile World Congress in Barcelona, which begins on Monday.

“I think the initial purchases will have a lot of overlap with smartphone users.”

He said the company considered a range of price points, from entry-level to luxury, for a car it is spending $10 billion to develop.

Xiaomi introduced its SU7 electric car in China at the end of December, but has not yet announced a specific price. Lu said a formal release would come “very soon” and hinted that domestic deliveries would begin as early as the second quarter.

The Beijing-based company is the market leader in the smartphone industry and ranks third in global shipments Apple and Samsung, according to Canalys. Data from the technology market analysis firm showed that Xiaomi captured about 13% of the global market in 2023, shipping 146.4 million phones.

The company has also expanded in recent years into televisions and home appliances that can be controlled via smartphones and often feature a sleek, white design. The majority of Xiaomi’s sales come from phones, with almost 30% coming from home appliances and other consumer goods.

Xiaomi is generally known for cheaper products. That raises doubts about whether the company can sell an electric car – touted as a competitor to Porsche – in a market that appeals to even established electric giants BYD lower the prices.

We believe this will not be the case in the future [that] But we actually give the device the instructions [that] The device can understand your needs and proactively address your needs

Weibing Lu

Xiaomi, President

Lu said Xiaomi’s approach is based on the development of an ecosystem as well as a “premiumization” strategy for smartphones launched in 2020, which has “made very good progress” since then.

In a conference call in November, he noted that the company had compared its latest Xiaomi 14 phone to the iPhone 15 Pro, claiming the new device would “overtake.” Appleis according to a FactSet transcript.

However, Huawei is also reducing Apple’s market share, whose popular Mate60 Pro starts at 6,499 yuan ($900), between the price range of the Xiaomi 14 Pro and the iPhone 15 Pro.

According to Canalys, Huawei recorded a 47% year-on-year increase in smartphone shipments in the mainland in the fourth quarter, putting it ahead of Xiaomi.

Building on its technical capabilities as a telecommunications and smartphone company, Huawei has quickly become a player in China’s electric car market.

The company launched the Aito vehicle brand in late 2021 and sells its HarmonyOS operating system and other software to several automakers. Huawei is also promoting some of these cars, including the high-priced Aito M9 SUV, by displaying them in its smartphone stores.

Apple has not yet officially entered the electric car market, although it is reportedly working on it. Chinese startup in the fall Nio has released its own Android smartphone.

Ecosystem development

Xiaomi launched a new operating system called HyperOS in the fall.

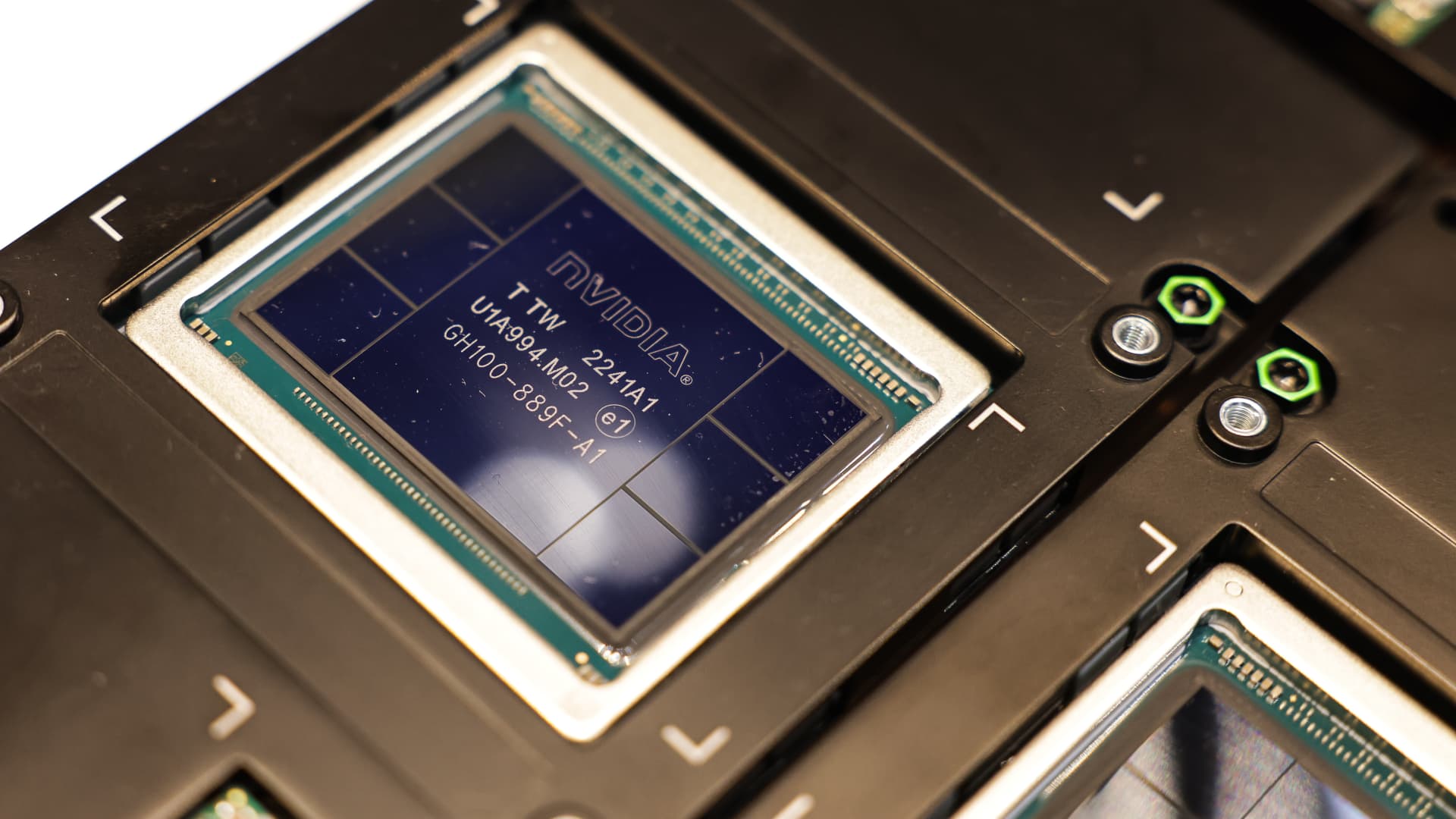

The system is claimed to contain an artificial intelligence component that can learn from user behavior to automatically adjust connected devices, such as home lighting.

“We believe this will not be the case in the future [that] But we actually give the device the instructions [that] “The device can understand your needs and proactively address your needs,” Lu said.

The company calls the strategy “People x Car x Home.”

HyperOS is currently only available on Xiaomi’s 14 phone. But the system will be expanded to home appliances and the upcoming car in the coming months, Lu said.

Read more about electric vehicles, batteries and chips from CNBC Pro

Spending billions of dollars on the ecosystem and the car are all part of Xiaomi’s efforts to survive in an industry that the company expects to become even more competitive.

In 10 or 20 years, the electric vehicle market will likely be very similar to today’s smartphones – with the top five brands holding about 70% of the market, Lu said. “Without major resources we don’t think we can reach the finals.”

After the first car, the next step for Xiaomi is to build its own factories and produce key components in-house, Lu said.

Xiaomi announced earlier this month that its new smartphone factory in Beijing has started operations and has a production capacity of more than 10 million devices.

A subsidiary of the state-owned Baic Group is currently listed as the manufacturer of the SU7 car in Chinese government publications. Xiaomi told CNBC that there is currently no public information to share.

An “amplifier” for Xiaomi is being marketed abroad

Similar to a growing number of Chinese companies, Xiaomi is also looking abroad for future growth. Over the past six years, between 40 and 50% of the company’s sales have come from outside mainland China, primarily Europe and India.

Lu, who joined Xiaomi Group in 2019, is also president of the international business department and said he spends “a lot of time” in the overseas market.

“It will be the amplifier for Xiaomi’s business,” he said, pointing out that the foreign consumer electronics market is about three times larger than China’s.

As part of his trip to Barcelona for MWC, Lu said he is visiting Paris as well as Africa and the Middle East.

He acknowledged that the political environment is making it more difficult for Xiaomi to operate globally, but said the company can overcome these challenges by building internal capacity and diversifying the business globally and by product.

As for the car, Lu declined to give a time frame for its overseas launch, but said it would typically take two to three years.

Source link

2024-02-26 07:00:25

www.cnbc.com